Obtaining an education loan for BBA students is an important financial commitment that needs careful consideration. Whether it is an MBA in India or overseas, understanding the loan process for 2026 is important.

Choosing to study for a Bachelor of Business Administration (BBA) degree is the first step in a management career. For most, this leads to aspirations of an MBA from a top-tier school. However, the further along in the process, the greater the challenge posed by rising costs of education.

Obtaining a proper education loan is more than just funding a degree. For BBA students, it is a critical financial choice that will shape the student’s net worth for 20 years.

BBA students and their families miss out on key information: they often choose a loan offer without considering their hidden costs, processing fees, and forgone tax benefits. This can result in losing more than a lakh in interest.

This guide is aimed at empowering BBA students in 2026 who will be applying for loans with the relevant strategies to successfully maneuver the intricate world of educational financing. By considering the five key components described below, you BBA students will be able to manage to obtain the most economical loan and lessen the amount of interest to be paid.

Choosing the Right Education Loan for BBA Students: Collateral vs. Non-Collateral

BBA students must tackle the education loan process by first deciding whether they want a collateral or a non-collateral loan. This choice will determine the interest rate a loan will have, the maximum amount a loan will cover, and the length of the processing time.

Collateral Loans (Secured Loans)

Collateral loans require borrowers to secure the loan with a collateral. Collateral can be an asset (a house, apartment, or land) as well as a liquid sheet, which can be a Fixed Deposit, an insurance policy, or a government-backed security.

- Key Feature: Because the bank has security, the risk is lower, resulting in the lowest interest rates in the market (typically offered by Public Sector Banks like SBI and Bank of Baroda).

- Requirement: Collateral is mandatory for most loans exceeding ₹7.5 Lakhs, especially for overseas education.

Non-Collateral Loans (Unsecured Loans)

Non-collateral loans do not ask for any asset to be pledged. Rather, the loan is processed keeping in mind the academic profile of the student, the standing of the institution, and the income of the co-borrower (parent or guardian).

- Key Feature: These loans are faster to process and are primarily offered by Private Banks and NBFCs. They are the preferred route for students who lack family assets to pledge.

- Strategic Tip: For BBA students aiming for top-tier institutions (e.g., IIMs, IITs, or top global universities for their MBA), many lenders offer high-value non-collateral loans, sometimes up to ₹50 Lakhs, based purely on the quality of the admission letter. This is a crucial point for future MBA loan interest rates 2026 planning.

Top Banks Comparison for Education Loans (2025-26)

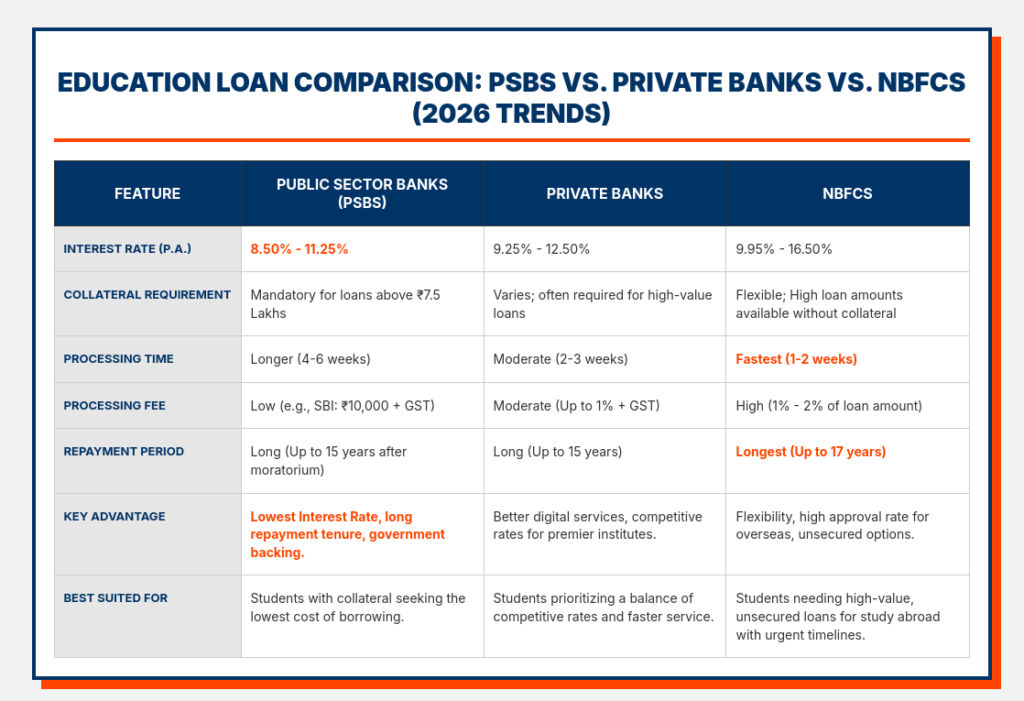

There is heavy competition among banks that provide education loans. While public sector banks (PSBs) provide the lowest rates compared to non-banking financial companies (NBFCs), whose loans have the most flexibility. The following table provides the comparison that BBA students should focus on for their loan application in 2026.

| Bank Name | Interest Rate (Approx) | Max Loan (Without Collateral) | Key Feature |

| SBI (Public Sector) | 8.50% – 9.50% | Up to ₹7.5 Lakhs | Lowest interest rates, 0.50% concession for female students. |

| HDFC Credila (NBFC) | 10.25% – 12.50% | No Upper Limit (Profile-based) | Fastest processing, covers holistic expenses, specialized in overseas study. |

| ICICI Bank (Private) | 9.25% – 11.50% | Up to ₹50 Lakhs (Select Institutes) | Fast digital sanction process (i-Education Loan). |

| Bank of Baroda (PSB) | 9.15% – 10.50% | Up to ₹7.5 Lakhs | Competitive rates for top global universities, long repayment tenure. |

| Axis Bank (Private) | 9.50% – 12.50% | Up to ₹45 Lakhs (Select Institutes) | Strong digital platform and customer service, flexible repayment options. |

Strategic Takeaways from the Comparison:

- Cost Minimization: If you want to take out a loan of ₹ 7.5 Lakhs, or you have collateral, the SBI student loan guide is the best starting point. Since the rates of the Public Sector Banks (PSBs) are the lowest, they provide the best value in the long run.

- Flexibility and Speed: If you need a high-value education loan without collateral for a top BBA program or are applying for overseas education, NBFCs like HDFC Credila offer the necessary speed and flexibility, despite the higher interest rate.

- The Middle Ground: Private Banks such as ICICI and Axis provide a decent mix of competitive pricing and quicker loan approvals, making them the best option for students who appreciate efficiency and are willing to pay less than NBFC for a loan.

Understanding the “Moratorium Period” & Interest Subsidy

The moratorium period and interest subsidy are two important factors that influence the total cost and repayment burden.

The Moratorium Period

The moratorium period is a duration where borrowers are not obligated to pay interest or the principal amount. It generally covers the duration of the course plus 6 to 12 months (or until the student finds a job, whichever comes first).

- Impact on BBA Students: With a standard 3-year BBA program, a moratorium period means that students begin paying their Equated Monthly Installments (EMIs) after 3.5 to 4 years. This means that students will fully start their EMIs, but will continue to accrue interest on their loans. Paying simple interest during the moratorium period is a good practice to keep interest from compounding and significantly increasing the total loan amount. This is offered by many banks, and is especially useful to students who will start their loans during the moratorium period.

The Central Sector Interest Subsidy (CSIS) Scheme

The CSIS Scheme is a government initiative aimed to help students belonging to economically weaker sections.

- Eligibility: Students whose family’s annual gross income is below ₹4.5 Lakhs are eligible.

- Benefit: The government pays the full interest accrued during the moratorium period (course duration plus one year). This effectively makes the loan interest-free during the study period, offering immense relief to low-income families.

How to Save Money with Tax Benefits (Section 80E)

When you take an education loan, you enjoy one of the most valuable benefits which is the tax benefit under section 80E of the Income Tax Act 1961. This benefit must be considered in the long term financial planning of a BBA student and is one of the most critical components of it.1. Deduction of Interest: All interest amounts paid for an education loan in 1 financial year can be claimed as a deduction from your income. There is no upper limit for this deduction. This can be claimed for the next eight assessment years and can continue until the interest is paid in full.

- 100% Deduction on Interest: The entire amount of interest paid on the education loan during a financial year is 100% deductible from your taxable income. There is no upper limit on the amount of interest that can be claimed, and the deduction is available for up to eight consecutive assessment years or until the interest is fully paid, whichever is earlier.

- Example: If your annual taxable income is ₹10 Lakhs and you pay ₹2 Lakhs in loan interest, your new taxable income becomes ₹8 Lakhs, resulting in significant tax savings.

- Concession for Female Students: As noted, many Public Sector Banks, including SBI, offer a 0.50% interest concession for female students. This small percentage translates into substantial savings over a 15-year repayment period and is a key factor to consider when comparing offers.

Step-by-Step Checklist to Apply for a Loan

An organized method will typically result in getting the best loan offer and provide you with the least amount of hassle. The following steps will help you when applying for the loan.

1. Define your requirement: Assess and specify the loan you need for tuition, accommodation, textbooks, and living expenses.

2. Assess Actual Collateral Availability: Provide details on whether or not you are able to pledge collateral. If you can, focus on PSBs. If you can’t, focus on Private Banks and NBFCs.

3. Shortlist Lenders: Depending on your collateral position and your BBA College’s standing, make a preliminary selection of 3-4 lenders (e.g., SBI for a lower interest rate, HDFC Credila when there’s no collateral).

4. Complete Documentation: Ensure that the documents you have meet the requirements of the lenders, including the admission letter, your academic transcripts, the income documents of the co-applicant (ITR, salary slips), and collateral papers (if any).

5. Compare Final Offers: Between the lenders you have shortlisted, compare the sanction letters you have. Instead of looking only at the interest rate, look at the Effective Interest Rate (EIR), which includes other charges and fees.

6. Sign the Agreement: When you are ready, go ahead and sign the loan agreement. Make sure you are aware of the moratorium details and the pre-payment penalties (if there are any).

“While preparing your BBA project documents, you can use our [Acknowledgement Generator] to save time.”

Frequently Asked Questions

Can I get an education loan for an MBA without collateral?

Yes, of course. If you have an offer from a top-tier school (for example, IIMs, ISB, or any other premier private schools), then a number of banks and NBFCs are willing to extend large tickets for unsecured loans, frequently from ₹40-50 Lakhs, linked to institute ranking and your academic credentials. This is the industry benchmark for MBA loan interest rates 2026 planning.

What is the maximum duration for the repayment of an education loan?

Most banks in India typically offer a repayment period of up to 15 years, excluding the moratorium period. NBFCs usually offer a longer period, some even up to 17 years, which provides more flexibility for managing monthly EMIs.

Do education loans include living expenses and laptops?

Yes, an education loan is intended to cover all expenses related to an education. This spans tuition, accommodation, books and materials, a laptop, and even travel expenses for studying abroad. Always check with the lender what is specifically covered.

Can I make an early payment on my loan without incurring a penalty?

It is an advantage that most Public Sector Banks (like SBI) do not include a pre-payment penalty, while private lenders and NBFCs are likely to include a penalty if the loan is paid off before the term ends. It’s important to familiarize yourself with the pre-payment clauses before finalizing the loan.

Create a Certificate for project file instantly with our Project Certificate Generator

Conclusion

Beginning the journey towards becoming a successful manager starts with a financial decision, and a rather timely one at that. The education loan market in 2026 will offer plenty of options, and while the best option may be dependent on individual circumstances, doing the necessary groundwork allows you to differentiate between collateral and non-collateral loans, and with the help of Section 80E, you will be able to secure a loan that reduces your financial burden in the long run. Always remember, a loan with the lowest interest rates invariably saves you the most money in the long run, hence making Public Sector Banks the most viable option for those who will offer collateral. Others will find that NBFCs provide the most value, as they offer world class education without financial constraints.

Download Full 2026 Loan Trend Presentation (PPT)

References

[1] Nomad Credit. (2025, December 19). 2026 Student Loan Interest Rates Explained: Why Rates Aren’t Dropping Despite Inflation Cooling.

[2] BankBazaar.Education Loan Interest Rates – Compare Banks & NBFCs.

[3] State Bank of India.Education Loan Scheme – Interest Rates.

[4] HDFC Credila.Education Loan Interest Rates and Charges.

[5] Lorien Finance. (2025, October 30).Best Education Loan for Study Abroad: Avanse vs Credila.

👨💼 Author: BBAProject Editorial Team

✍️ The BBAProject Editorial Team comprises business graduates and educators dedicated to creating practical, syllabus-based learning resources for BBA students.

⚠️ Please Note: Articles published on BBAProject.in are well-researched and regularly updated. However, students are advised to verify data, statistics, or references before using them for academic submissions.