Working capital refers to the finances a company needs to operate on a day-to-day basis. While businesses always commit a lot of their budget to long-term business assets, a company’s actual viability hinges on how well they manage their short-term finances—cash, inventory, and receivables. That’s where working capital management becomes important, to make sure a business can pay bills and keep the lights on, while also producing and having the funds to cover any financial emergencies. For a BBA student and a future manager, it is important to know the types of working capital, the distinction between fixed and working capital, and the working capital management meaning in order to make informed financial decisions that will promote stability and growth.

Working Capital Meaning

What is working capital meaning in the real world? It is more than just a quick textbook formula. It is the liquid oxygen that keeps every single operational activity alive. It is the money that is available right now – there is no delayed gratification – to pay for raw materials, wages, transportation, advertising, utilities, and taxes.

Take the example of a manufacturing unit. The owner has fixed assets worth ₹3 crore in machinery. He has an inventory of ₹1.8 crore in finished goods and raw materials; ₹90 lakh in the bank; and ₹1.2 crore owed to him by customers. Total current assets amount to ₹3.9 crore. However, he owes ₹2.1 crore to suppliers, has a salary pending ₹40 lakh, and has a bank overdraft of ₹30 lakh due in a week. Total current liabilities come to ₹2.8 crore.

His working capital amounts to ₹3.9 crore minus ₹2.8 crore, which equals ₹1.1 crore.

For as long as this ₹1.1 crore remains, he can afford to place the next order for raw materials, pay the workers, and keep the machines running. However, if for two consecutive months this amount becomes zero, production will come to a halt — and this will happen regardless of the fact that the order book may be full.

Having positive working capital equals freedom for a business. On the other hand, negative working capital for a lengthy period of time can lead to the collapse of the business.

Objectives of Inventory Management & Types of Inventory Management Systems

Working Capital Management

The daily discipline of management of working capital is to keep the current assets and current liabilities in a relationship of perfect equilibrium. This is done by a combination of science — involving ratios, cycles, and forecasting — and art which involves negotiation with suppliers, persuading customers for faster payments, and anticipating seasonal changes in the business.

Every day, a well-prepared manager takes account of five questions:

- How many days of inventory do we have today?

- How many days we have receivables?

- How many days of trade credit do we currently have?

- Are we using the optimal source of short-term funds?

- How will cash flow be impacted if we experience a 30% increase in sales next month?

Determining these factors will tell if a business is able to be self-sufficient, or become impacted by a cycle of high interest borrowing.

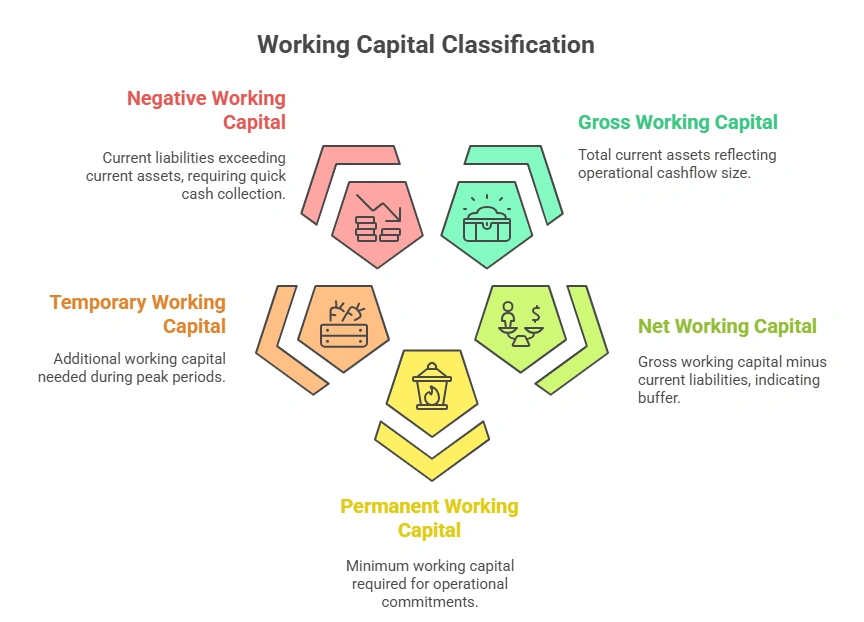

Types of Working Capital – A Complete Classification

Working capital is cash required to fund day-to-day operations and can be classified in to five categories, these being:

Gross working capital.

This is money held in all the business’ current assets, and shows the size of the company’s operational cashflow in a particular moment in time.

Net working capital.

This is gross working capital less current liabilities. This reflects the true working capital buffer in the business to absorb or defend the business against working capital fluctuations. Healthy businesses are able to maintain a net working capital position equal to 2-3 months of operating expenditure.

Permanent working capital.

This is the minimal level of working capital required by a business to honour its operational commitment. Every business, even the smallest, have minimum operational costs. For example, a bakery has to always have atleast 8 lakh worth of flour, butter and sugar. That is its permanent working capital.

Temporary (or Fluctuating) Working Capital

Additional working capital needed during peak periods. For example, a garment exporter requires ₹4 crores more in September–October for festive orders — that’s temporary working capital.

Negative Working Capital

This happens when current liabilities surpass current assets. This requires a business to collect cash quicker than its expenditures, a situation that large-format retailers and quick-commerce players purposely designed their operations to achieve — they quite literally expand using others’ funds.

How to Calculate Net Working Capital – With Real-Life Scenarios

Calculating net working capital is straightforward, but truly understanding the significance requires some experience.

Let’s analyse the data from a few hypothetical case studies for a better understanding of the above concepts.

Example 1 – A wholesale trader

Current Assets:

- Cash 15,00,000

- Stock 1,40,000,000

- Debtors 85,00,000 total – 2,40,00,000

Current Liabilities:

- Creditor 1,60,00,000

- Bank OD 40,00,000 total – 2,00,00,000

NWC = 40,00,000 (Crowded, but can be managed.)

Example 2 – A Seasonal Firecracker Manufacturer (Off-Season vs Peak)

Off-Season NWC = 60,00,000

Peak Season NWC = 32,00,000,00 (Due to temporary working capital)

Example 3 – A Supermarket Chain (Negative on Purpose)

Current Assets 45,00,00,000

Current Liabilities 52,00,00,000

NWC = -7,00,00,000, but the business is growing 40% YoY because cash is collected on a daily basis while suppliers take 60 days.

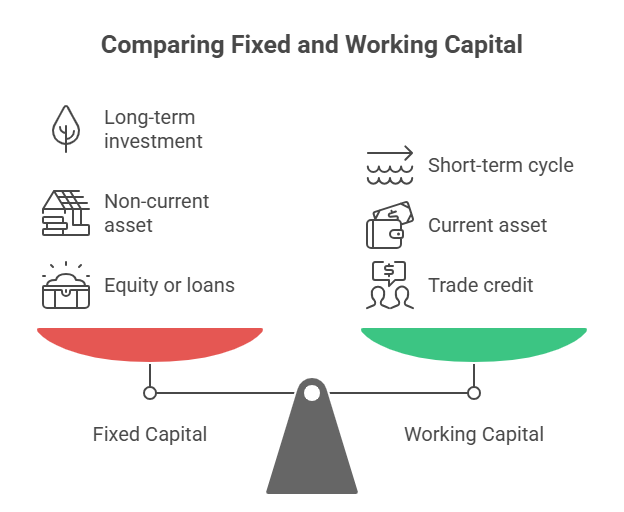

Difference Between Fixed Capital and Working Capital

This is one of the most misunderstood concepts, but it is extremely simple.

- Fixed capital is locked for a long time, and it does not change unless you make a new capital expense (land, buildings, heavy machinery, patents, long-term software licenses).

- Working capital, on the other hand, is revolving. It changes from cash to inventory, then to receivables before being cycled to cash again in 30 to 90 days.

- Working capital is the amount that is tied down in cash.

- Fixed capital gives you the ability to earn money, and the working capital ensures that that ability is working to maximum capacity.

- Fixed capital is classified as a non-current asset and working capital is the largest component of the current assets section of the balance sheet.

- Fixed capital is funded through owner’s equity, term loans or debentures. Working capital is funded through trade credit, bank overdrafts, commercial papers, or factoring.

Difference Between Cost and Financial Accounting | Explained in Simple Terms

The Everyday Practices That Can Actually Save You

- Just-in-time inventory

By doing more frequent and smaller batch ordering, you can lower the average inventory days from 90 days to 35 days.

- Early payment discounts

By giving a 2 % discount to buyers who pay within 10 days as opposed to 45, you get a lot of large buyers that pay you. This also cuts your cash cycle.

- Supplier negotiations

As your purchase volume increases, try to change the credit terms from 30 days to 60 days. This gives you more capital for longer.

- Factoring without recourse

Instead of waiting 90 days to get your money, sell your invoices to specialized finance companies and you’ll receive 92-95 % of the money within 48 hours.

- Supply Chain Finance

Let third-party financiers meet suppliers on day one, while you finance them after 90 days at 9–11%, which is cheaper than a bank overdraft.

- Cash Flow Forecasting

Use basic Excel or modern solutions to forecast cash shortfalls 60 days in advance, and only arrange funds when required.

Most Costly Working Capital Errors (and how to avoid them):

- Holding a 6-month frontend raw material in stock, as “prices could rise”

- Issuing 120-day credits to small retailers while paying suppliers in 30 days

- Keeping ₹5 crore that is idle in a current account as opposed to short-term liquid funds

- Using long-term project finance to cover working capital needs

- Overlooking festive season spikes and running out of cash when sales peak

- Failing to review aging reports, such as letting ₹50 lakh in receivables become 180 days overdue

Conclusion

In the year twenty twenty-five, the management of working capital will be the most important driver of business expansion and the most powerful business secret.

Have a complete comprehension of the meaning of working capital, differentiate it from fixed capital, and weekly measure your net working capital. Relentlessly implement the above suggestions to manage working capital effectively, and you will never experience a cash crunch regardless of how quick your growth.

FAQ – Working Capital Management

What is working capital meaning in the simplest way?

Cash that is available after settling all your payable accounts and can be utilized to manage your operations.

How to calculate net working capital accurately?

Every month, take your current assets and from that subtract your current liabilities.

Difference between fixed capital and working capital?

Fixed capital refers to long-term assets that you cannot convert into cash easily, for example machinery or land. Working capital refers to short-term funds that you can convert to cash easily such as debtors, cash, or stock.

Is it accurate to say there is a downside to all negative working capital?

Not at all. When it is intentional negative working capital, it is a propulsion system for growth. When it is unintentional, it is a catastrophe.

What is considered a good current ratio?

For most industries, \textbf{1.2 up to 2.0} ratio is what is considered good.

What is the most single biggest mistake that kills working capital the fastest?

Having a lot of inventory and holding onto it for months.

👨💼 Author: BBAProject Editorial Team

✍️ The BBAProject Editorial Team comprises business graduates and educators dedicated to creating practical, syllabus-based learning resources for BBA students.

⚠️ Please Note: Articles published on BBAProject.in are well-researched and regularly updated. However, students are advised to verify data, statistics, or references before using them for academic submissions.