Price Elasticity of Demand – For BBA students, it’s a crucial concept that explains how the change in price can influence consumer demand and enable business strategies. As part of the Business Law and Economy content, students learn how to make pricing decisions to maximize revenue and perform well in tests and internships. From setting prices at a retail store to analyzing market trends, the Price Elasticity of Demand provides BBA students with tools to make informed decisions. For anyone planning a career in business, understanding Demand Measurement can be the key to unlocking your effectiveness and productivity, especially when looking at how managers take decisions.

What is Price Elasticity of Demand ?

The price elasticity of demand is a measure of how responsive consumer’s are to price changes. It’s a fundamental concept in business economics, demonstrating how a price rise or fall influences sales. For instance, if a product is priced at ₹100 and retail price goes up to ₹120, will consumers purchase it? Price Elasticity of Demand is the answer to this, and enables businesses to set the best price possible. This is important for those BBA students who further want to do projects in marketing and economics where you have to analyze pricing strategies of a fictitious online store.

Demand Measurement is an important topic coming under BBA syllabus, in which numerical problems are asked (e.g., computation of elasticity) and theory questions such as its impact or explanation. In internships, students may suggest discounts for a small business to increase sales based on elasticity. For instance, a student examines data that indicates whenever prices dip by 10%, sales double — guiding the pricing strategy. Price Elasticity of Demand is important for exams and in running a business so it is worth learning!

Types of Price Elasticity of Demand

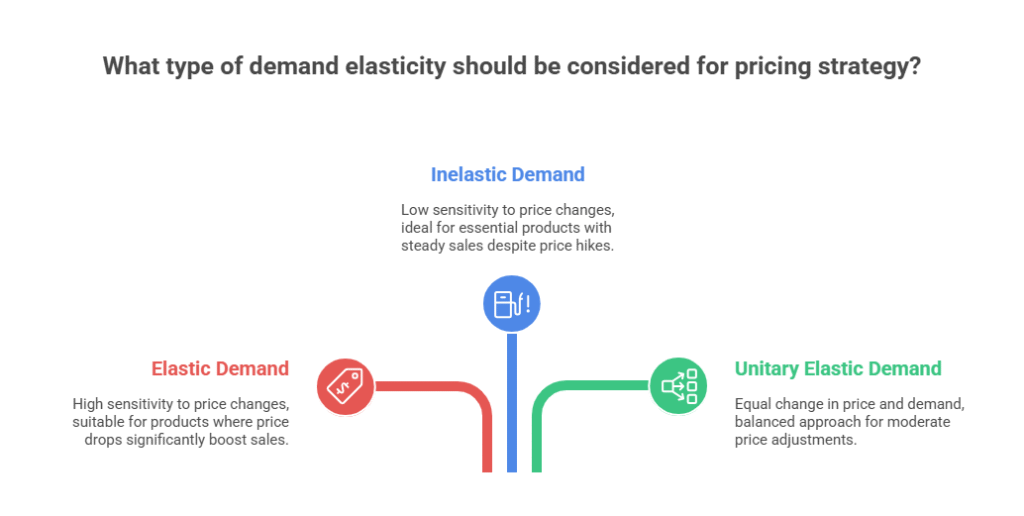

PED changes depending on how much demand reacts to a change in price. The types students should be familiar with for ascertaining markets are:.

Demand is elastic if the percentage change in quantity demanded exceeds the percentage change in price (elastic \(> 1\)). For instance, for luxury goods such as high-end smartphones demand can stretch — a 10% price increase might shrink sales by 15%. Inelastic Demand- little change in demand for a product when there is change in its price (elasticity <1). Absolute essentials like salt have inelastic demand; a 10% price increase might cut sales by only 2%. Unitary Elastic Demand is a compromise between them: the percentage change in price leads to a corresponding percentage change in demand (i.e., elasticity of 1). Perfect Elastic Demand (infinite) says that any price increase will immediately reduce demand to 0, as the case when products are exact substitutes in a perfect competition market. Perfectly Inelastic Demand (zero elasticity) means demand doesn’t change, such as life-saving drugs.

Example: A store discovers that it can sell snacks at 5% less and increase sales by 10% (elastic), but sells just as much sugar even when they charge more for it (inelastic).

Key types:

- Elastic Demand: High sensitivity to price changes. Example: Price drop on fashion items boosts sales.

- Inelastic Demand: Low sensitivity to price changes. Example: Fuel sales remain steady despite price hikes.

- Unitary Elastic Demand: Equal change in price and demand. Example: A 5% price cut increases sales by 5%.

Exam Tip: Memorize elasticity types with examples for theory questions.

Methods to Measure Price Elasticity

Measurement of Demand Price Elasticity of demand can be measured by the following methods. These can be then used by BBA students in their projects and exams:

The Percentage Method This is probably the most widely used, you calculate it as: E = (% Change in Quantity Demanded) ÷ (% Change in Price). Example: If a product’s price falls from ₹100 to ₹90 (-10% change) and the quantity sold increases from 1,000 to 1,200 (+20%) E = 20% ÷ −10% = −2 (elastic). The Total Revenue Method determines elasticity by examining how revenue preferences. If a lower price brings in more revenue overall, then the demand is elastic. Example: A ₹10 drop in price increases sales from 1,000 to 1,300 units and revenue goes up from ₹1,00,000 to ₹1,17,000 (elastic). With the Point Method, an exact point-price-quantity is utilized to make calculations in a way that works out well when writing numbers.

Example: Lets assume the Price has dropped from ₹50 to ₹45 (10% decrease) and sales had gone up from 500 units to 600 units (20% increase). E = 20% ÷ 10% = 2 (elastic).

Key methods:

Percentage Approach: A method to calculate elasticity based on percentage changes. Example: E = 20% ÷ 10% = 2 for a reduction of snack price.

Total Revenue Approach: Examines revenue to measure elasticity. Example: An increase in revenue is observed after a price reduction, which means demand is elastic.

Exam Tip: Practice percentage method converting for numerical questions.

Applying Elasticity in Business Decisions

Price Elasticity of Demand: A smart strategy for BBA students to have a business edge. In BBA Projects, students can apply elasticity to advise on pricing. For instance, a retail business project may present that elastic products such as fashion items can increase sales by lowering prices. In internships, students might crunch some data to determine discounts at a small business. For example: A 10 % reduction for electronics raise sell-through by 25%, which validates the strategy.

Elasticity also influences marketing and inventory decisions. Businesses can charge higher prices — and not lose sales — for inelastic products like medicines. Numerical Example: For Sugar (inelastic), a 5% increase in price from ₹40 to ₹42/kg results in only a 1% decrease in sales, leaving revenue at ₹39,600 ([math]x[/math] drops from 1,000 to 990). For BBA students: Student can explain the pricing strategies through elasticity in viva, leading to better project and internship results.

Key applications:

Pricing: Lower prices in response to more elastic Price Elasticity of Demand. Example: Offer snacks at a discount because doing so will drive sales.

Marketing Decisions: Advertise inelastic products with fixed pricing. Example: Market essentials like fuel.

Exam Tip: Relate elasticity to pricing in your discussion of case-based questions.

Overcoming Challenges in Understanding Elasticity

BBA students face challenges in mastering Price Elasticity of Demand. Calculating elasticity can be tricky due to complex formulas. Practice with simple datasets—Example: Use price (₹100 to ₹90) and sales (1,000 to 1,100 units) to calculate E = 10% ÷ 10% = 1. Limited data access can hinder analysis; students might lack sales data for projects. Use hypothetical data or secondary sources like industry reports. Misinterpreting elasticity types is common, like confusing elastic with inelastic demand. Review definitions regularly to avoid errors.

Numerical Example: A student miscalculates elasticity as inelastic (E < 1) when sales rise 15% after a 10% price cut (E = 1.5, elastic). Double-check formulas to ensure accuracy.

Key challenges and solutions:

- Complex Calculations: Practice with simple datasets. Example: Calculate E for small price/sales changes.

- Limited Data: Use hypothetical or secondary data. Example: Source market trends from free reports.

Exam Tip: Discuss calculation challenges in descriptive answers.

Table: Types of Price Elasticity of Demand

| Elasticity Type | Impact | Business Application |

|---|---|---|

| Elastic | Large demand change | Lower prices for sales |

| Inelastic | Small demand change | Maintain higher prices |

| Unitary Elastic | Equal demand-price change | Balance pricing strategies |

Conclusion

Price Elasticity of Demand is the best tool a BBA student has, if they smartly follow business because its greatest position ot write your Business Strategy down is “Demand Measurement” 🙂 Knowing types of elasticity, measurement techniques and its application can help students better prepare for BBA projects, internships and exams. Apply this guide to become an expert in Price Elasticity of Demand and design a successful career in business economics.

👨💼 Author: BBAProject Editorial Team

✍️ The BBAProject Editorial Team comprises business graduates and educators dedicated to creating practical, syllabus-based learning resources for BBA students.

⚠️ Please Note: Articles published on BBAProject.in are well-researched and regularly updated. However, students are advised to verify data, statistics, or references before using them for academic submissions.