If you’ve heard the saying, “Don’t put all your eggs in one basket,” you probably have a sense of Portfolio Management. In the finance and business sectors, Portfolio Management moves beyond simply allocating funds to investing; it involves balancing, strategically controlling, and minimizing risks and returns.

For BBA students, learning Portfolio Management is about more than just the theories; it is also about the mindset of real investors, firms and financial managers as they strategically and systematically balance multiple assets. This article aims to cover each aspect in detail, such as the definitions and significance of portfolio management, the strategies employed, the balance of risk and return, and a number of real-world examples.

Understanding Portfolio Management

Portfolio Management is the art of selection, tracking, and overseeing a mix of investment securities—like stocks, bonds, and mutual funds—and other assets to reach a financial target.

To put it simply, it’s about answering the questions:

Where to put your money, How much to put, and When to adjust those assets.

In the end, the goal of portfolio management is to bring in the largest returns while balancing the risks according the investors’ level: conservative, moderate, or aggressive.

Key Aims of Portfolio Management

A portfolio manager or individual investor works with certain goals in mind. Most of the goals include:

Capital Growth – The value of the investment will grow over time as the value of the capital increases.

Regular Income – Income will be earned in the form of dividends, interest, or rent.

Safety of Principal – The invested capital will be safeguarded against high loss.

Liquidity – The ability to convert assets into cash.

Tax Efficiency – A legal plan to minimize taxes.

Each investor is given a unique portfolio since the risk tolerance, time horizon, and financial goals are different.

Types of Portfolio Management

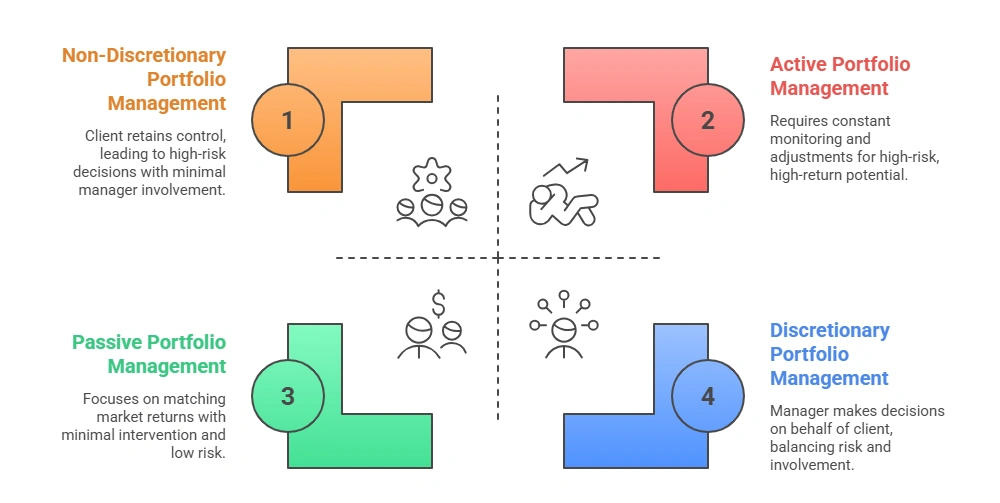

To make this clearer, portfolio management is separated into four main types, which cater to different clients and investor goals.

Active Portfolio Management.

It is characterized by constant buying and selling of securities with the intent to outperform the market. The manager analyzes the market trends and adjusts investments frequently.

Passive Portfolio Management.

It is characterized by an approach which is focused on matching market returns by investing in index-based securities. Changes are made less frequently.

Discretionary Portfolio Management.

The manager makes investment decisions with or on behalf of the client according to the goals agreed on.

Non-Discretionary Portfolio Management

. The manager outlines a plan, but the decision and investments remain with the client.

Active management is something a young professional looking for fast growth would likely choose. In contrast, a retiree would probably go for passive management or discretionary management, as they want less involvement on a day-to-day basis.

The Portfolio Management Process

You don’t manage a portfolio once and forget about it, as it is a continuous process that involves a cycle of strategic planning, execution, and ongoing review.

Here’s how it works step by step:

- Identifying Investor’s Objectives

The first step is figuring out what an investor is looking for: growth, income, safety, or a combination of a few. To do this, they take an investor’s age, finances, and future goals into account.

- Asset Allocation

After goals are clear, the manager decides how to split up the investments over different classes:

Equity (shares)

Debt (bonds, deposits)

Real Estate

Cash or Cash equivalents

How this split is done is very important, as it decides how much risk the portfolio will take on.

- Selection of Securities

After figuring out how much of each asset class to use, the next step is to choose specific securities. For instance, for the 40% equity allocation, the decision would be about which stocks to select and what percentage of that 40% to each stock.

- Portfolio Optimization

This is the process of managing the balance of risk and return, which is done with diversification and rebalancing, to get the maximum return for a specific level of risk.

- Performance Evaluation and Review

Your goals and the markets change over time. For this reason, the portfolio must be checked at regular intervals. Replaced lost-performing assets and retained, or rebalanced successful ones.

Importance of Portfolio Management

As with all other functions, portfolio management also has great importance for both individual and institutional investing. Here’s Why:

Risk Diversification: It limits the extent of risk by spreading loss over several different assets. (Mastering Financial Risk Management Strategies to Ensure Lasting Business Growth)

Goal Achievement: Making sure the strategy being used is relevant to the financial target to be met.

Efficient Decision Making: Having a strategy brings discipline to the investing process.

Performance Improvement: Evaluating a strategy regularly and frequently leads to a positive enhancement.

Psychological Comfort: A positive, affective, planned investment framework reduces stress.

The Balance of Risk and Return

As with all other economic activities, investing involves risk, and the higher the risk, the higher the returns. Portfolio Management is the control of optimizing the risk and returns effect.

Example:

Consider that Investor A places all of his money on equity shares, waiting for maximum returns. Investor B, on the other hand, splits his investment – 60% into shares and 40% into bonds.

If equity markets collapse, Investor A’s all equity shares would be affected substantially. Investor B’s stock and bond portfolio would be affected less, and would perform moderately.

The balance of risk and return is the essence of the portfolio management.Diversification is the Core Principle

Diversification is the practice of spreading investments so that the poor performance of one does not negatively impact the rest of the investments.

For instance:

Balancing investments in equity (for growth) and bonds (for stability).

Investing in different sectors like healthcare and IT or manufacturing.

Putting some money in international assets for some global exposure.

A well-diversified portfolio can eliminate unsystematic risk (risk that is related to a single company or to a single industry).

Modern Portfolio Theory (MPT) is the Scientific Approach

Modern Portfolio Theory is a concept introduced by Harry Markowitz, which aims to provide a mathematical perspective of how to attain the optimal returns for a particular level of risk. According to MPT, investors should:

Combine low correlating assets.

Think of their investments as one portfolio rather than multiple.

Determine risk by using standard deviation and beta.

MPT, in simple words, helps in the formation of an “efficient frontier” — the portfolios that provide maximum returns for each level of risk.

Case Study: Practical Understanding

To make the concept a bit clearer, let us take a simple case study.

For a young investor looking at a 10-year horizon and considering both growth and safety, a suggested structure would be:

| Asset Type | Percentage | Purpose |

|---|---|---|

| Equity Funds | 50% | Long-term capital appreciation |

| Government Bonds | 25% | Stability and fixed income |

| Real Estate | 15% | Diversification and asset growth |

| Cash and Liquid Assets | 10% | Liquidity for emergencies |

After 2 years, Equity and Government Bonds performed strongly, while Real Estate slow down. The Manager modified the portfolio to reduce Real Estate and increase Equity.

With this approach, an investor is not at risk of missing their financial goals.

Challenges in Portfolio Management

These challenges can hinder even the most seasoned investors:

Market Volatility: The value of an asset can quickly change with the economy.

Behavioral Biases: Investors’ emotions can lead to poor decisions.

High Risk: Risk increases when an investor is overexposed to a single asset.

Tight Fiscal Policies: Changes to interest rates, taxes, inflation can shift the value of returns.

Great portfolio managers maintain a disciplined framework fueled by data and robust analysis to dismantle these challenges.

Role of Portfolio Manager

A portfolio manager slows down an investors financial goals by diagnosing the goals, prescribe the right investment mix and regularly check the health of the portfolio.

Here are their primary responsibilities:

Knowing what investors want.

Making investment choices.

Adjusting asset distribution.

Evaluating performance and rebalancing as required.

Being open and transparent with clients.

Conclusion

Unlike most Disciplines, Investment Management combines several Human Factors with Systematic Components. It requires a unique combination of advanced finance knowledge, analytical techniques, and a balanced mindset.

For students pursuing their BBA, mastering this discipline is fundamental to building a career in finance, investment analysis, and wealth management.

Portfolio management is about control, not elimination. The balance between risk and safe, the aim, is to allow growth with risk.

Portfolio Management FAQ

What is the primary goal of investment management?

To provide the highest returns while controlling the risk and exposure defined by the investor.

What is diversification in portfolio management?

Integration of different asset classes to dilute the effect of a poorly performing asset on the portfolio.

What are the major types of portfolio management?

Active, Passive, Discretionary, and Non-Discretionary Portfolio Management.

Why portfolio review important?

Since market conditions and personal goals change over time, regular reviews ensure that the investments remain aligned with the objectives.

How can a beginner start with portfolio management?

By understanding personal goals, learning the basic investment options, starting small, and then concentrating on diversification and consistency.

👨💼 Author: BBAProject Editorial Team

✍️ The BBAProject Editorial Team comprises business graduates and educators dedicated to creating practical, syllabus-based learning resources for BBA students.

⚠️ Please Note: Articles published on BBAProject.in are well-researched and regularly updated. However, students are advised to verify data, statistics, or references before using them for academic submissions.