The Indian Partnership Act, 1932 and the Law of Agency under the Indian Contract Act, 1872, form the backbone of many business relationships, enabling collaboration and efficient operations. Understanding these laws is essential for mastering Business Law and Economics exams and succeeding in entrepreneurial or managerial roles. This article explores the key provisions of the Partnership Act, 1932, the principles of the Law of Agency, and their business implications, such as cost-sharing and operational efficiency. With clear examples, practical insights, and exam-focused tips, this guide equips you to navigate these laws and apply them in real-world scenarios.

Overview of the Indian Partnership Act, 1932

The Indian Partnership Act, 1932, governs partnerships in India, defining how businesses can be formed, managed, and dissolved by individuals sharing profits and responsibilities. A partnership is a voluntary association of two or more persons who agree to carry on a business with a common goal of earning profits, as outlined in Section 4 of the Act. Unlike companies, partnerships are simpler to establish, making them popular for small and medium-scale enterprises.

The Act regulates critical aspects like partner rights, liabilities, and firm dissolution, ensuring clarity in business operations. Its provisions are vital for entrepreneurs and professionals managing collaborative ventures, offering a legal framework for trust and accountability.

Exam Tip: Define partnership and cite Section 4 for short-answer questions.

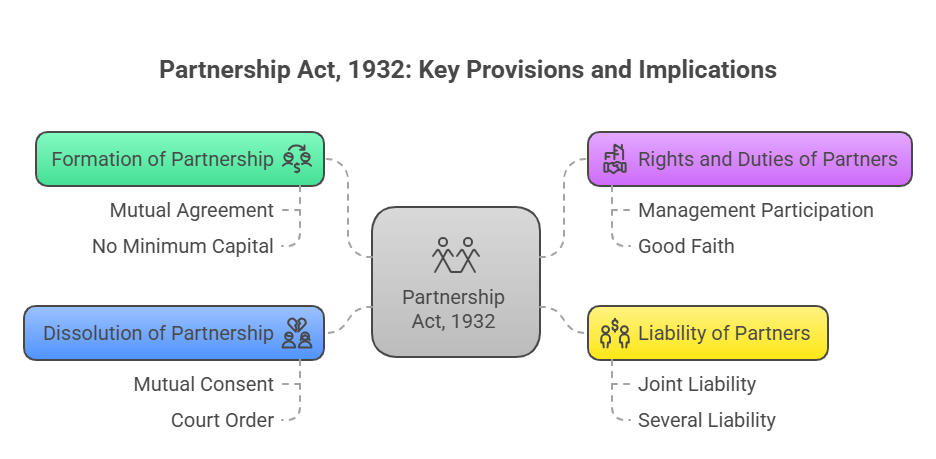

Key Provisions of the Partnership Act, 1932

The Partnership Act, 1932 outlines several provisions that shape partnership operations:

- Formation of Partnership

- Requires a mutual agreement (oral or written) among partners to share profits.

- Example: Two individuals start a retail firm, agreeing to split profits equally.

- Details: No minimum capital is mandated, but registration under Section 58 enhances legal credibility.

- Rights and Duties of Partners

- Partners have rights to participate in management, access books, and share profits (Section 12).

- Duties include acting in good faith, avoiding personal profits, and contributing to losses (Section 13).

- Example: A partner in a trading firm consults others before making major decisions.

- Details: Mutual agency allows each partner to bind the firm legally.

- Liability of Partners

- Partners are jointly and severally liable for firm debts (Section 25).

- Example: If a partnership firm defaults on a loan, all partners are personally liable.

- Details: Liability extends to acts within the firm’s business scope.

- Dissolution of Partnership

- Occurs by mutual consent, insolvency, or court order (Sections 40-44).

- Example: A consultancy firm dissolves when partners agree to pursue separate ventures.

- Details: Assets are distributed to settle debts and partner claims.

Table: Key Provisions of Partnership Act, 1932

| Provision | Key Benefit | Challenge | Exam Tip |

|---|---|---|---|

| Formation | Simple setup process | Lack of registration risks | Define essentials in theory |

| Rights and Duties | Ensures equal participation | Conflicts over decisions | List duties in descriptive answers |

| Liability | Shared responsibility | Unlimited personal risk | Explain joint liability in viva |

| Dissolution | Flexible exit options | Asset distribution disputes | Discuss grounds in case studies |

Exam Tip: Memorize sections (e.g., 12, 25) and examples for viva questions.

Law of Agency Under Indian Contract Act, 1872

The Law of Agency, governed by Sections 182-238 of the Indian Contract Act, 1872, defines relationships where an agent acts on behalf of a principal in dealings with third parties. An agent is authorized to represent the principal, creating legal obligations for the principal within the scope of authority.

The Law of Agency is crucial for businesses delegating tasks like sales, procurement, or negotiations, enhancing operational efficiency. It applies to scenarios like a sales agent representing a manufacturer or a broker negotiating deals.

Conditions vs Warranties in the Sale of Goods Act: A Complete Guide for Students

Key Provisions of Agency

- Creation of Agency

- Formed by express agreement, implication, or ratification (Section 187).

- Example: A business appoints an agent to negotiate supplier contracts.

- Details: No formal contract is mandatory, but clear terms prevent disputes.

- Duties of an Agent

- Act within authority, follow instructions, and maintain accounts (Sections 211-213).

- Example: An agent selling goods remits proceeds to the principal promptly.

- Details: Agents must avoid conflicts of interest and personal gains.

- Rights of an Agent

- Includes right to remuneration, lien on goods, and indemnity (Sections 219-221).

- Example: An agent claims commission for securing a deal.

- Details: Rights depend on the agency agreement terms.

- Termination of Agency

- Occurs by mutual consent, revocation, or principal’s death (Sections 201-210).

- Example: A principal terminates an agent’s authority for non-performance.

- Details: Notice is required to avoid liability for agent’s actions post-termination.

Exam Tip: Explain agency creation and termination with examples in descriptive answers.

Consumer Protection Act, 2019: Your Guide to Consumer Rights and Remedies

Business and Economic Implications

The Partnership Act, 1932 and Law of Agency have significant business implications, driving efficiency and collaboration:

- Cost-Sharing in Partnerships

- Partners pool resources, reducing individual financial burdens.

- Example: A retail firm’s partners share costs for inventory and rent.

- Economic Impact: Lowers entry barriers for small businesses.

- Operational Efficiency via Agency

- Agents handle specialized tasks, freeing principals for strategic roles.

- Example: A manufacturer uses agents to expand market reach.

- Economic Impact: Enhances productivity and market access.

- Risk Distribution

- Partnerships spread financial risks among partners; agency limits principal’s direct involvement.

- Example: A trading firm’s partners share loan repayment risks.

- Economic Impact: Encourages entrepreneurship by mitigating risks.

- Legal Accountability

- Both laws ensure clear responsibilities, fostering trust.

- Example: An agent’s actions bind the principal, ensuring contract enforcement.

- Economic Impact: Supports stable business relationships.

Table: Business Implications of Partnership and Agency

| Implication | Economic Benefit | Practical Challenge | Exam Tip |

|---|---|---|---|

| Cost-Sharing | Reduces financial burden | Profit-sharing disputes | Link to partnership in theory |

| Operational Efficiency | Expands business reach | Agent misconduct risks | Discuss agency benefits in viva |

| Risk Distribution | Encourages entrepreneurship | Unlimited liability risks | Explain risk-sharing in cases |

| Legal Accountability | Builds trust with stakeholders | Legal disputes over authority | Cite sections in descriptive answers |

Exam Tip: Link implications to economic outcomes (e.g., efficiency) in case studies.

Challenges in Applying Partnership and Agency Laws

Implementing these laws faces hurdles, with solutions:

- Partner Disputes

- Conflicts over profits or decisions disrupt operations.

- Example: Partners in a retail firm disagree on expansion plans.

- Solution: Draft clear partnership agreements.

- Unlimited Liability

- Partners face personal liability for firm debts.

- Example: A trading firm’s partner sells personal assets to settle firm loans.

- Solution: Register as a limited liability partnership (LLP).

- Agent Misconduct

- Agents exceeding authority create legal risks.

- Example: An agent signs an unauthorized deal, binding the principal.

- Solution: Define authority limits in contracts.

- Termination Issues

- Improper termination leads to disputes or liabilities.

- Example: A principal revokes agency without notice, facing legal claims.

- Solution: Follow statutory notice requirements.

Exam Tip: Discuss challenges with legal provisions (e.g., Section 25) in long-answer questions.

Practical Applications in Business

The Partnership Act, 1932 and Law of Agency offer practical benefits:

- Entrepreneurial Ventures: Partnerships enable small-scale startups.

- Example: A consultancy firm pools expertise and capital.

- Market Expansion: Agents facilitate sales or procurement.

- Example: A manufacturer appoints agents to reach new regions.

- Risk Management: Shared liabilities reduce individual exposure.

- Example: A trading firm distributes loan risks among partners.

- Operational Flexibility: Agency allows task delegation.

- Example: A service firm uses agents for client negotiations.

Example Scenario: Two entrepreneurs form a partnership to run a retail firm, sharing costs and profits. They appoint an agent to negotiate supplier deals, boosting efficiency. The Partnership Act ensures equal rights, while the Law of Agency clarifies the agent’s authority, driving business success.

Tips to Master Partnership and Agency for Exams

To excel in Business Law and Economics:

- Learn Provisions: Memorize key sections (e.g., Partnership Act Section 4, Contract Act Section 182).

- Understand Implications: Link laws to business outcomes like cost-sharing.

- Use Tables: Revise provisions and implications for quick recall.

- Check Resources: Visit India Code for legal texts.

- Prep for Vivas: Explain mutual agency or agent duties with examples.

Conclusion

The Indian Partnership Act, 1932 and Law of Agency provide a robust framework for business collaboration, with significant business implications like cost-sharing and efficiency. By mastering their provisions—partnership formation, liabilities, agency duties, and termination—you can ace exams and apply these laws in entrepreneurial ventures. Use this guide to navigate the Partnership Act, 1932 and Law of Agency, and explore resources like Ministry of Corporate Affairs to deepen your knowledge and excel in your career.

👨💼 Author: BBAProject Editorial Team

✍️ The BBAProject Editorial Team comprises business graduates and educators dedicated to creating practical, syllabus-based learning resources for BBA students.

⚠️ Please Note: Articles published on BBAProject.in are well-researched and regularly updated. However, students are advised to verify data, statistics, or references before using them for academic submissions.