The Paradox of Prosperity: Higher Income, Lower Financial Comfort

India is a country that is witnessing rapid economic growth, reflected in the jump in the country’s GDP, the total income of the population, and the country’s growing consumer base. India’s middle class is of the most dimension as they are the main engines of growth in this economy. However, a major paradox exists in this country as a section of the population continues to earn and feel financially unstable and poorer than the previous generation.

In this article, we explore the components that caused this financial squeeze and the numerous social and economic complexities that caused the feeling of impoverishment. The feeling of impoverishment is not fake; it is due to numerous components that include stagnant wage growth, swiftly increasing the cost of essential items and the continuous pressure towards lifestyle inflation. The thesis is clear; the financial stress faced by the middle-income earners is as a result of the high taxation/poor services offered by the state, increasing financial polarization and increasing non-discretionary expenditures.

Most define the middle class using annual income ranges, like one study that identifies the core middle class as earning between ₹5 lakh and ₹1 crore annually . This is the stratum where financial anxiety is most palpable.

The Income Stagnation Trap and Economic Polarization

The Indian economy has expanded but the earnings of various segments of society have begun diverging, which is referred to as economic polarization or the ‘hollowing out’ of the middle [2]. For over a decade, quantifiable data has shown that the income of a certain middle-income cohort on average has stagnated. For example, from one of the studies, the average income of tax filers in the ₹5 lakh to ₹1 crore tax bracket has increased marginally from ₹10.23 lakh to ₹10.69 lakh.

In contrast, people in the bottom income bracket (earning less than ₹5 lakh) have experienced a significant income growth, and the top-income bracket (earning more than ₹1 crore) has also experienced a significant income growth . This shows that economic growth has benefitted the lower and higher income brackets more than the middle cohort. This stagnation might be due to the global pattern of job polarization. This means that J. Smith explains that technology and automation affect jobs that require a middle level of skills the most and leave both the high and low skilled jobs untouched. The jobs which are losing their middle-class status include the clerical, secretarial, and supervisory roles. Therefore, the job market is changing into a high paying, low paying, and no paying split. The Indian middle class is losing this job hierachy and cannot see a growth in their salary anymore

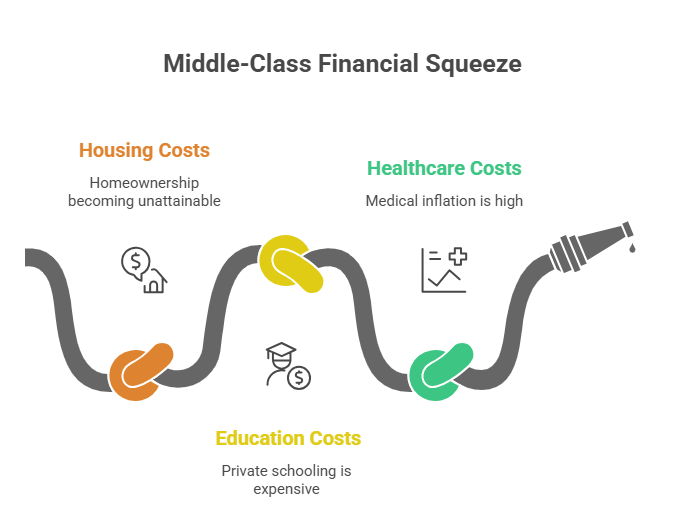

The “Big Three” Cost Drivers: Housing, Education, and Healthcare

The most important determinant that is increasing pressure on the middle class is the increasing cost of the non-discretionary and aspirational budget items — the Big Three, which include housing, education, and health care.

Housing: The Fading Dream of Homeownership

A generation ago, home ownership represented middle-class stability. From the vantage point of millennial, especially in big cities, that dream is becoming increasingly difficult to attain. In cities, property prices continue to outpace income growth. Even high-earning professionals are finding home ownership to be increasingly unobtainable. The belief that millennial could be the final generation with the potential to purchase a home in the major urban centers highlights the seemingly paradoxical fact that even essential assets have become exorbitantly priced. This forces many people to take out mortgages with exorbitantly high interest rates, restricting their disposable income and capacity to save.

Education: The Private School Premium

Middle-class families must pay the high cost of private schooling, as the public schooling system is inadequate, resulting in the burden of paying for quality schooling. Parents must pay for private schooling, and then pay coaching fees, then pay for higher education to foreign institutions or at the best local universities, which results in the loss of financial self-determination of the family. Financial commitments lead to family planning, where couples decide to have one child as they can control the financial burden of education escalation. School fees for private education can go as high as 3 to 4 lakhs for nursery admissions.

Healthcare: A Crisis of Medical Inflation

Our healthcare is terrifying. The inflation of the healthcare system is currently sitting at 14%, one of the highest in Asia. The public healthcare system is of poor quality. The middle class has to rely on private hospitals and extremely expensive health insurance. One expensive illness or health issue is all it takes to wipe all the savings of someone in the middle class. This is because there is no safety net with public healthcare, so they must pay the risk of losing everything. This is offsetting the perception of how wealthy they are.

The Taxation Paradox and Debt Burden

The middle-class financial squeeze is made worse by a taxation system that, while offering a sliver of relief, feels punitive considering the quality of public services rendered.

People usually think about how middle class people pay First World taxes, but get Third World services. They pay taxes on income, then on goods and services, and more. They have to spend money on private security, water, power, education, and healthcare. They are then taxed twice. A large part of their income is spent on services that the state should provide, making their disposable income also low.

The Union Budget of 2025 is the first to provide some tax relief to middle class people – people can now make up to 12 lakh rupees and pay no taxes on it. But when this tax relief comes, other things are also taken away to make it fair. Now taxpayers can no longer use section 80c to deduct their taxes to protect their savings, or pay less on their house due to an interest deduction. This means that people now have more money in their pockets, but it means that people now have less money in the future. Overall, this relief on taxes means that the middle class will ultimately pay more taxes in the future.

Adding to this pressure is the silent increase in household debt. As aspirations increase, and household income decreases, more and more credit is being used by India’s middle-class families. India’s household debt-to-GDP ratio has been steadily increasing, and is projected to reach 42% in 2024-2025. While the figure is still less than that of several developed countries, the increase reflects an increasing burden of household debt but also illustrates the reliance on household credit to afford basic necessities, increasing the financial strain.

Lifestyle Creep and the Social Media Mirror

Psychological and social explanations of poverty are most visible in the impact of lifestyle creep. Since the mid-level of income has increased in a geographic area, the overall expenditures in that area also begin to increase and align with those levels of income, leaving residents at the same place financially–often with no increase in savings or overall financial stability.

This lifestyle creep is amplified by social media and the comparison game that emerges from it. In earlier generations, the benchmark middle-class aspiration was to keep pace with one another by avoiding visible disparities in consumption of goods or status. In today’s digitized, media-saturated environment, that benchmark is to keep pace with influencers, who are not bound by economic constraints, increasing consumption of potentially worthless goods and services. Also, the disappearance of willing cheap labor is an important factor. Because of a labor scarcity, and subsequent rise in low-income group wages, the price of domestic services such as maids, cooks, and drivers housing has gone up. While this is a positive for the low-income group, it removes the domestic help and leisure that were a part of the previous generations of middle class. From the perspective of the middle class, this leads, in part, to more domestic work, and lowers their standard of living.

Portfolio Management: Building Wealth with Smart Strategies

Conclusion: Redefining Financial Security

Pertaining to the middle class of India, there is a sense of increased impoverishment, even in the presence of higher wages. This is attributed to an economic imbalance created by constant real wages and the inflation of fundamental housing and housing related services like education and health. This is made more complicated by a taxation system that forces the privatization of public services, combined with a culture that promotes spending on credit.

Middle-class families should look beyond increases in nominal income as their measurement of financial security. They should instead focus on real wealth creation. This implies a long-term mental shift towards saving, building real, long-term assets, and completely consuming less on transitory shorts. With respect to lifestyle creep, there is a real cost to consuming more. The real costs of lifestyle creep must be assessed and managed. Policymakers must fix the structural issues: the right quantity and quality of public goods should result from the middle-class tax paid, and the inflation in the Big Three should be adequately contained. Only then, perhaps, can India’s middle-class attain the financial self-sufficiency and confidence that economically empowering the country equally demands.

References

[1] India’s Middle Class Struggles Amid Economic Growth(LinkedIn, Dec 2025).

[2]India’s Middle Class is Losing Ground to the Rich & the Poor(Marcellus, Jan 2025).

[3]The Skill Content of Recent Technological Change: An Empirical Exploration(Autor, Levy, Murnane, 2003).

[4]India’s middle class faces harsh reality as lifestyle affordability could be under threat(The Economic Times, Oct 2025).

[5]Healthcare cost in India rising by 14 per cent annually: Report(Economic Times Health, Sep 2024).

[6]The Muddle of the Progressive Taxation System in India(SSRN, 2025).

[7]Union Budget 2025: Tax bonanza for middle class(The Hindu, Feb 2025).

[8]India Households Debt To GDP(Trading Economics, Q2 2025).

[9]India’s Young Earners Succumb to Lifestyle Inflation Trap (Whalesbook, Jan 2026).

Mastering Financial Risk Management Strategies to Ensure Lasting Business Growth

👨💼 Author: BBAProject Editorial Team

✍️ The BBAProject Editorial Team comprises business graduates and educators dedicated to creating practical, syllabus-based learning resources for BBA students.

⚠️ Please Note: Articles published on BBAProject.in are well-researched and regularly updated. However, students are advised to verify data, statistics, or references before using them for academic submissions.