Financial statements are like a report card for a business, showing how it’s doing money-wise. They’re super important for students learning accounting because they help you nail exams, do great in internships, and get ready for jobs. This guide explains financial statements in a simple way, shows you how to prepare final accounts for a sole proprietorship, breaks down cash flow and fund flow statements with lots of details, and looks at a real company to make it all click. Let’s jump in!

What Are Financial Statements?

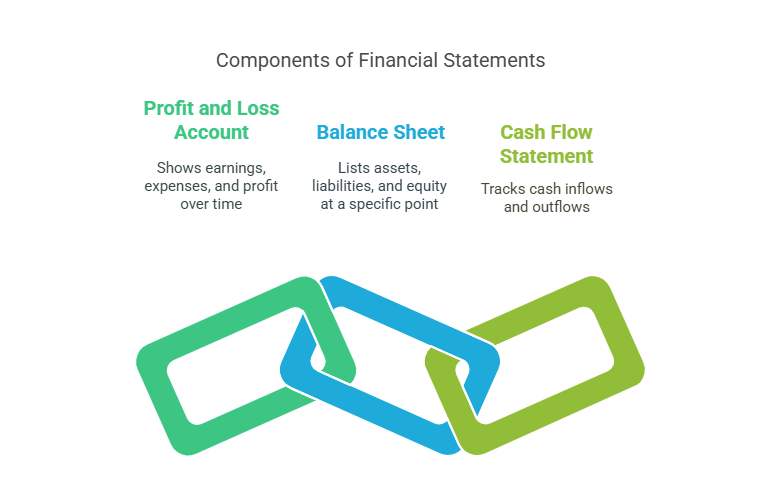

Financial statements are reports that sum up a business’s money matters. They help owners, investors, and managers figure out what’s going on. There are three main types:

- Profit and Loss Account: Shows money earned, spent, and profit made over time.

- Balance Sheet: Lists what the business owns (assets), owes (liabilities), and the owner’s share (equity) at one point.

- Cash Flow Statement: Tracks cash coming in and going out.

A 2024 study by AICPA says 78% of small businesses use financial statements to get loans, so they’re a big deal in the real world.

Why Financial Statements Are Important

Financial statements matter because they:

- Show How the Business Is Doing: Tell if it’s making money or losing it.

- Help Make Plans: Guide decisions like investing or cutting costs.

- Follow Rules: Needed for taxes and audits in India.

- Score Marks in Exams: A key topic in accounting, often worth lots of points.

Let’s start with final accounts.

Preparing Final Accounts for a Sole Proprietorship

Final accounts wrap up a sole proprietorship’s finances for the year. They include the trading account, profit and loss account, and balance sheet, showing profit and financial position.

Steps to Prepare Final Accounts

- Make a Trial Balance: List all account balances (debits and credits) to check they match.

- Do the Trading Account: Find gross profit by subtracting cost of goods sold (COGS) from sales.

- Formula: Gross Profit = Sales – COGS

- Create the Profit and Loss Account: Take away expenses (like rent or salaries) from gross profit to get net profit.

- Build the Balance Sheet: List assets (like cash or inventory) and liabilities (like loans) to show the business’s position.

- Adjust for Extras: Include things like depreciation or unpaid bills.

Example: Final Accounts Format

Here’s an example for Ravi’s General Store (year ending March 31, 2025):

Trading Account (for the year ended March 31, 2025)

| Particulars | Amount (₹) | Particulars | Amount (₹) |

|---|---|---|---|

| Opening Stock | 50,000 | Sales | 5,00,000 |

| Purchases | 3,00,000 | Closing Stock | 60,000 |

| Gross Profit (to P&L A/c) | 2,10,000 | ||

| Total | 5,60,000 | Total | 5,60,000 |

Profit and Loss Account (for the year ended March 31, 2025)

| Particulars | Amount (₹) | Particulars | Amount (₹) |

|---|---|---|---|

| Rent | 40,000 | Gross Profit | 2,10,000 |

| Salaries | 60,000 | ||

| Depreciation | 10,000 | ||

| Net Profit (to Capital) | 1,00,000 | ||

| Total | 2,10,000 | Total | 2,10,000 |

Balance Sheet (as on March 31, 2025)

| Liabilities | Amount (₹) | Assets | Amount (₹) |

|---|---|---|---|

| Capital (1,50,000 + 1,00,000) | 2,50,000 | Cash | 80,000 |

| Creditors | 30,000 | Inventory | 60,000 |

| Machinery | 60,000 | ||

| Total | 2,80,000 | Total | 2,80,000 |

This format pops up a lot in exams, so practice it to ace your tests!

Cash Flow vs Fund Flow Statement: Explained in Detail

Financial statements include cash flow statements and fund flow statements, which look at how money moves in a business. They’re different but super important. Let’s dig into each one, with steps to make them, examples, and real-world cases to make it clear.

Cash Flow Statement: Where’s the Cash Going?

A cash flow statement shows how cash comes into and leaves a business over a period, like a year. It’s all about whether there’s enough cash to pay bills, salaries, or other daily needs. It has three parts:

- Operating Activities: Cash from the main business, like sales or paying suppliers.

- Investing Activities: Cash used to buy things like machines or received from selling assets.

- Financing Activities: Cash from loans, repaying debts, or paying dividends.

How to Prepare a Cash Flow Statement

- Begin with Net Profit: Take the net profit from the profit and loss account.

- Add Non-Cash Items: Include things like depreciation (it reduces profit but isn’t cash spent).

- Adjust for Working Capital: Factor in changes in inventory, receivables (money owed to the business), or payables (money the business owes).

- Calculate Each Section:

- Operating: Net profit + adjustments.

- Investing: Cash spent or gained from assets.

- Financing: Cash from loans or paid out (like dividends).

- Find Total Cash Change: Add all three sections to see the net change in cash.

- Check Cash Balance: Match the closing cash with the balance sheet.

Example: Cash Flow Statement (Ravi’s General Store, 2025)

| Particulars | Amount (₹) |

|---|---|

| Cash Flow from Operating Activities | |

| Net Profit | 1,00,000 |

| Add: Depreciation | 10,000 |

| Less: Increase in Inventory | (10,000) |

| Add: Increase in Creditors | 5,000 |

| Net Operating Cash Flow | 1,05,000 |

| Cash Flow from Investing Activities | |

| Purchase of Machinery | (20,000) |

| Cash Flow from Financing Activities | |

| Loan Repayment | (10,000) |

| Net Increase in Cash | 75,000 |

| Opening Cash Balance | 5,000 |

| Closing Cash Balance | 80,000 |

Real-World Example: In 2024, Zomato generated ₹1,200 crore in operating cash flow, letting it expand its delivery network without taking new loans, according to Economic Times. This shows how cash flow statements help businesses manage money for growth.

Why Cash Flow Matters

- Day-to-Day Operations: Ensures cash for rent, salaries, or supplies.

- Planning: Helps decide if a business can afford new projects.

- Exam Tip: Practice numericals, as cash flow calculations are common in tests.

Fund Flow Statement: Tracking Bigger Money Moves

A fund flow statement looks at changes in working capital (current assets like cash and inventory minus current liabilities like creditors) over time. It shows where funds come from (like profits or loans) and where they go (like buying assets or paying debts). It’s great for planning long-term goals, like expanding a business.

How to Prepare a Fund Flow Statement

- Find Working Capital Changes: Compare current assets and liabilities from two balance sheets (e.g., this year vs last year).

- List Sources of Funds:

- Profits from operations.

- Selling assets (like old equipment).

- New loans or owner’s investment.

- List Uses of Funds:

- Buying fixed assets (like machines).

- Paying off loans or dividends.

- Balance the Statement: Sources minus uses equals the change in working capital.

- Verify: Check that the statement matches balance sheet changes.

Example: Fund Flow Statement (Ravi’s General Store, 2025)

| Sources of Funds | Amount (₹) | Uses of Funds | Amount (₹) |

|---|---|---|---|

| Net Profit | 1,00,000 | Purchase of Machinery | 20,000 |

| Loan Received | 20,000 | Loan Repayment | 10,000 |

| Increase in Working Capital | 90,000 | ||

| Total | 1,20,000 | Total | 1,20,000 |

Working Capital Calculation:

- 2024: Current Assets (₹60,000) – Current Liabilities (₹25,000) = ₹35,000

- 2025: Current Assets (₹1,40,000) – Current Liabilities (₹30,000) = ₹1,10,000

- Increase: ₹1,10,000 – ₹35,000 = ₹75,000 (adjusted for non-current items).

Real-World Example: In 2023, Tata Steel used a fund flow statement to show ₹5,000 crore from profits going into new plants, reducing working capital for long-term growth, as reported by Business Standard. This highlights how fund flow statements plan big investments.

Why Fund Flow Matters

- Long-Term Strategy: Shows how funds are used for growth, like opening new stores.

- Balance Sheet Link: Ties to changes in assets and liabilities, a key exam concept.

- Exam Tip: Learn to explain sources and uses for theory questions.

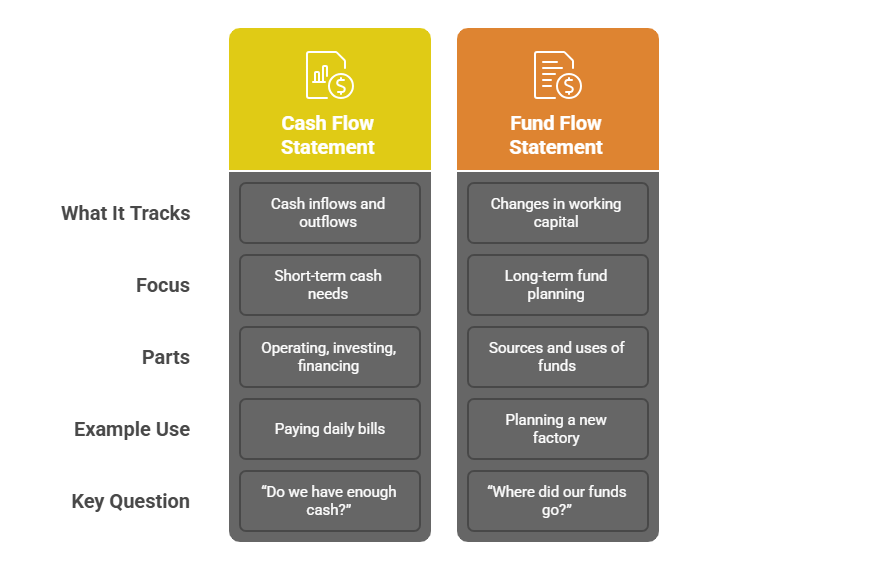

Cash Flow vs Fund Flow: Quick Comparison

| Aspect | Cash Flow Statement | Fund Flow Statement |

|---|---|---|

| What It Tracks | Cash inflows and outflows | Changes in working capital |

| Focus | Short-term cash needs | Long-term fund planning |

| Parts | Operating, investing, financing | Sources and uses of funds |

| Example Use | Paying daily bills | Planning a new factory |

| Key Question | “Do we have enough cash?” | “Where did our funds go?” |

Why This Helps: Understanding both financial statements lets you analyze a business’s cash for daily needs (cash flow) and its big-picture strategy (fund flow). These are hot topics in exams and internships.

What is Green Marketing? A Guide for Marketing Students

Real Case Study: Financial Statement Analysis of Reliance Retail

Let’s see financial statements in action with Reliance Retail, India’s biggest retailer, using 2024 data from Moneycontrol.

Background

Reliance Retail runs 18,000+ stores and earned ₹2.6 lakh crore in revenue in FY 2023-24. Its financial statements show how it grows.

Key Insights

- Profit and Loss Account:

- Revenue: ₹2,60,000 crore (up 20% from FY 2022-23).

- Net Profit: ₹8,000 crore, thanks to smart cost management.

- Takeaway: Strong sales tie to the trading account’s focus on revenue.

- Balance Sheet:

- Assets: ₹1,50,000 crore (stores, inventory, tech).

- Liabilities: ₹50,000 crore (loans for growth).

- Takeaway: High assets show investment, balanced by controlled debt.

- Cash Flow Statement:

- Operating Cash Flow: ₹12,000 crore, funding new stores.

- Investing Cash Flow: (₹5,000 crore), spent on tech upgrades.

- Financing Cash Flow: (₹2,000 crore), for loan repayments.

- Takeaway: Positive cash flow means Reliance Retail can cover daily costs easily.

- Fund Flow Statement:

- Sources: ₹8,000 crore from profits, ₹4,000 crore from loans.

- Uses: ₹10,000 crore for store expansion, ₹2,000 crore for debt repayment.

- Takeaway: Fund flow shows long-term focus on growing the store network.

What Students Learn

Reliance Retail’s financial statements show how businesses use profit and loss accounts to track earnings, balance sheets to manage assets, cash flow statements to handle daily cash, and fund flow statements to plan big moves. Try analyzing a company’s financials for your internship project to stand out!

Tips to Ace Financial Statements

To rock financial statements in exams and beyond:

- Memorize Formats: Know trading, profit and loss, and balance sheet layouts by heart.

- Practice Problems: Solve trial balance and cash flow numericals from past papers.

- Get the Differences: Be ready to explain cash flow vs fund flow in theory answers.

- Check Real Data: Look at company reports on sites like Investopedia to see financial statements in action.

- Prep for Vivas: Use examples like Reliance Retail to explain why financial statements matter.

Conclusion

Financial statements are your ticket to understanding a business’s money story. Preparing final accounts helps you calculate profits for sole proprietorships, while cash flow and fund flow statements show how cash and funds move for short-term needs and long-term plans. Real-world examples, like Reliance Retail’s 2024 financials, bring these ideas to life. Use this guide to crush your exams, impress in internships, and get ready for a finance career.

Get BBA Project Topics idea and Project prepration guide Here

👨💼 Author: BBAProject Editorial Team

✍️ The BBAProject Editorial Team comprises business graduates and educators dedicated to creating practical, syllabus-based learning resources for BBA students.

⚠️ Please Note: Articles published on BBAProject.in are well-researched and regularly updated. However, students are advised to verify data, statistics, or references before using them for academic submissions.