Financial management is the cornerstone of any organization, steering organizational decision-making to achieve organizational goals like profitability, growth, and stability. For BBA students, mastering financial management—its scope, role, and objectives—is essential for excelling in Finance & Accounting exams and thriving in finance careers. This article defines financial management, explores its broad scope in strategic decisions, and explains how its roles and objectives drive business success. Packed with practical examples and exam-focused insights, this guide will equip you to conquer this syllabus topic and shine in internships.

What Is Financial Management and Its Scope?

Financial management entails strategizing, coordinating, overseeing, and regulating an organization’s finances to meet its objectives effectively. It encompasses decisions about raising funds, investing them wisely, and distributing profits, ensuring the organization remains financially healthy. By guiding organizational decision-making, financial management balances risks and rewards to support long-term sustainability and short-term operations.

Scope of Financial Management

The scope of financial management is vast, covering key areas of organizational decision-making that shape a business’s financial strategy:

- Investment Decisions

- Distribute capital to initiatives, resources, or activities to optimize profits.

- Example: A manufacturing unit invests in automated machinery to boost production capacity.

- Details: Involves evaluating options like new product launches or facility expansions, using tools like ROI analysis to prioritize high-yield investments.

- Financing Decisions

- Determine the optimal mix of debt (loans, bonds) and equity (shares) to fund activities.

- Example: A retail business secures a bank loan for expansion while issuing shares to raise additional capital.

- Details: Requires analyzing interest rates, repayment terms, and shareholder expectations to minimize funding costs.

- Dividend Decisions

- Decide how much profit to distribute as dividends versus reinvesting in the business.

- Example: A consulting company distributes 35% of earnings as dividends to investors and channels 65% into digital enhancements.

- Details: Balances shareholder satisfaction with the need for growth capital, often guided by dividend policies.

- Liquidity Decisions

- Ensure sufficient cash to meet short-term obligations like salaries or supplier payments.

- Example: A trading business maintains a cash reserve to cover unexpected expenses.

- Details: Focuses on overseeing cash movements and liquid assets to prevent financial shortfalls.

Table: Scope of Financial Management

| Decision Area | Primary Challenge | Practical Step | Exam Tip |

|---|---|---|---|

| Investment Decisions | High risk of losses | Conduct feasibility studies | Define ROI in short answers |

| Financing Decisions | Balancing debt costs | Compare loan terms | Explain debt-equity mix in viva |

| Dividend Decisions | Shareholder pressure | Set sustainable payout ratios | Discuss policies in theory |

| Liquidity Decisions | Cash flow shortages | Forecast cash needs monthly | Link to working capital in cases |

Exam Tip: Memorize these four areas and their examples, as they’re frequently tested in both theory and practical questions.

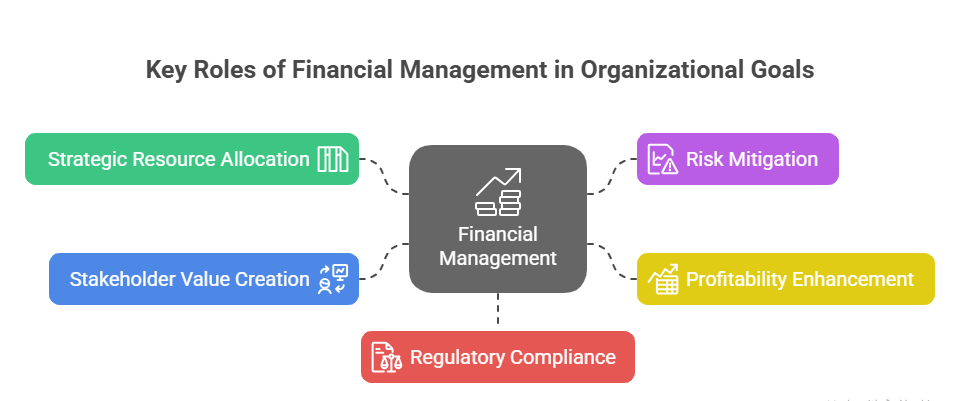

Role of Financial Management in Organizational Goals

Financial management plays a central role in achieving organizational goals by ensuring resources are used effectively and risks are minimized. Its key roles include:

- Strategic Resource Allocation

- Direct funds to priority areas like operations, R&D, or marketing.

- Example: A trading firm allocates funds to expand its supply chain network.

- Details: Prioritizes projects that align with goals like market expansion or cost reduction.

- Risk Mitigation

- Protect against financial uncertainties like market volatility or currency risks.

- Example: An export business uses hedging to manage foreign exchange fluctuations.

- Details: Employs tools like insurance or derivatives to safeguard profits.

- Profitability Enhancement

- Optimize revenues and control costs to boost net profits.

- Example: A factory optimizes its operations to minimize resource wastage.

- Stakeholder Value Creation

- Deliver returns to shareholders, employees, and creditors.

- Example: A service firm ensures timely loan repayments to maintain lender trust.

- Details: Balances payouts with reinvestment to satisfy all stakeholders.

- Regulatory Compliance

- Ensure adherence to financial laws like the Companies Act, 2013.

- Example: An enterprise submits precise GST filings to steer clear of fines.

- Details: Maintains transparency in financial reporting.

Exam Tip: Link these roles to specific organizational goals (e.g., growth, stability) in descriptive answers.

Objectives of Financial Management

The goals of financial management serve as a blueprint for attaining organizational aspirations. They are categorized as primary and secondary:

- Primary Objective: Wealth Maximization

- Increase shareholder value by boosting profits and market valuation.

- Example: A retail business adopts e-commerce to drive sales and stock prices.

- Details: Emphasizes sustained growth through well-planned investment choices.

- Secondary Objectives

- Profit Maximization: Generate consistent profits to fund operations and growth.

- Example: A manufacturing firm negotiates better supplier deals to improve margins.

- Liquidity Maintenance: Ensure cash availability for short-term needs.

- Example: A trading unit keeps a cash buffer for supplier payments.

- Social Responsibility: Support community or environmental initiatives.

- Example: A business funds local skill development programs.

- Stat: A 2024 Business Standard report noted CSR boosts brand value by 15%.

- Legal Compliance: Adhere to tax and financial regulations.

- Example: An enterprise submits precise GST filings to steer clear of fines.

- Profit Maximization: Generate consistent profits to fund operations and growth.

Table: Objectives of Financial Management

| Objective | Key Challenge | Action Plan | Exam Tip |

|---|---|---|---|

| Wealth Maximization | Market volatility | Diversify investments | Define in theory questions |

| Profit Maximization | Rising costs | Implement cost controls | Use examples in numerical cases |

| Liquidity Maintenance | Cash flow mismatches | Monitor cash flows weekly | Explain in liquidity questions |

| Social Responsibility | Budget constraints | Partner with NGOs | Discuss in CSR viva |

| Legal Compliance | Complex regulations | Hire compliance experts | Link to Companies Act in answers |

Exam Tip: Use this table to compare objectives in viva or long-answer questions.

How Financial Management Drives Decision-Making and Goals

Financial management integrates organizational decision-making with organizational goals through a strategic approach:

- Aligning Investments with Growth

- Investment decisions prioritize projects that drive expansion.

- Example: A manufacturing firm funds a new plant to enter new markets.

- Details: Uses forecasting to ensure alignment with revenue goals.

- Optimizing Financial Structure

- Financing decisions balance debt and equity for cost efficiency.

- Example: A retail business mixes loans and equity to fund digital transformation.

- Details: Reduces funding costs while maintaining solvency.

- Balancing Stakeholder Interests

- Dividend and CSR decisions satisfy shareholders and society.

- Example: A service firm pays moderate dividends and supports local education.

- Details: Enhances reputation and investor trust.

- Ensuring Operational Stability

- Liquidity and risk management maintain smooth operations.

- Example: A trading firm diversifies suppliers to avoid supply chain risks.

- Stat: A 2024 People Matters study found risk management improves stability by 22%.

Exam Tip: Explain this integration with generic scenarios (e.g., a firm achieving growth) in case-based questions.

Challenges in Financial Management

Implementing financial management faces several obstacles, with practical solutions:

- Economic Volatility

- Market fluctuations affect investment returns and profits.

- Example: A retail business faces reduced demand during inflation.

- Solution: Diversify revenue streams.

- Details: Regular market analysis helps anticipate trends.

- Regulatory Complexity

- Compliance with laws like GST or SEBI increases costs.

- Example: A production facility faces challenges with recurring tax inspections.

- Solution: Invest in compliance software or consultants.

- Details: Ensures timely and accurate filings.

- Resource Limitations

- Limited funds restrict investment or dividend payouts.

- Example: A consultancy business postpones growth plans due to limited funding.

- Solution: Prioritize high-ROI projects and explore low-cost funding.

- Details: Phased investment plans mitigate risks.

- Stakeholder Conflicts

- Balancing shareholder and operational needs creates tension.

- Example: Shareholders demand higher dividends, limiting reinvestment.

- Solution: Communicate clear financial strategies to stakeholders.

- Details: Transparent policies align interests.

Exam Tip: Discuss these challenges and solutions in long-answer or viva questions for depth.

Practical Applications in Business

Financial management delivers tangible benefits in organizational decision-making:

- Driving Growth: Strategic investments fuel expansion.

- Example: A trading firm opens new warehouses to reach more markets.

- Enhancing Efficiency: Cost optimization boosts profitability.

- Example: A manufacturing unit adopts energy-efficient processes.

- Building Resilience: Risk management ensures stability.

- Example: A retail business hedges against price volatility.

- Strengthening Reputation: CSR and compliance enhance trust.

- Example: A service firm supports community health programs.

Example Scenario: A retail business uses financial management to fund a new online platform (investment), secures a low-interest loan (financing), pays moderate dividends (dividend), and maintains cash reserves (liquidity), achieving sales growth and stakeholder satisfaction.

Understanding Financial Statements: Final Accounts, Cash Flow vs Fund Flow, and Real Case Studies

Tips to Master Financial Management for Exams

To excel in Finance & Accounting:

- Learn Key Concepts: Memorize the scope (investment, financing, dividend, liquidity) and objectives (wealth, profit).

- Understand Integration: Explain how decisions align with organizational goals.

- Use Tables: The scope and objectives tables are exam-ready for quick revision.

- Check Resources: Visit ICAI for financial management trends.

- Prep for Vivas: Discuss how wealth maximization drives long-term growth.

Conclusion

Financial management is the engine of organizational success, guiding organizational decision-making to achieve organizational goals like wealth creation, profitability, and stability. Its scope—spanning investment, financing, dividend, and liquidity decisions—ensures resources are used effectively, while its roles and objectives align strategies with business priorities. By mastering financial management, BBA students can ace exams, excel in internships, and prepare for finance careers. Explore resources like Economic Times to deepen your knowledge, and keep learning to conquer this vital topic!

👨💼 Author: BBAProject Editorial Team

✍️ The BBAProject Editorial Team comprises business graduates and educators dedicated to creating practical, syllabus-based learning resources for BBA students.

⚠️ Please Note: Articles published on BBAProject.in are well-researched and regularly updated. However, students are advised to verify data, statistics, or references before using them for academic submissions.