Our free startup valuation calculator provides estimated worth of your startup in a matter of minutes by simply filling out a couple questions, and no signup is required

Select Your Startup Stage:

Select Currency:

1. Qualitative Inputs (Risk Factor Summation Method)

This is your starting point based on regional average Seed Deal (e.g., 10000000 for 1 Crore or 1,000,000 for 1M USD).

Risk Factor Adjustments:

A. Management Team Experience & Commitment:

B. Clear Product-Market Fit Proof:

C. Market Size (TAM/SAM):

✅ Final Estimated Pre-Money Valuation

Your Negotiable Pre-Money Valuation Range (±15%):

₹ 0 - ₹ 0The startup valuation calculator is is a great tool for answering one of the most challenging questions in fundraising: ‘What is my company worth?’ Regardless of whether your company is a pre-revenue venture or an expanding company, our calculator incorporates sophisticated, customized techniques for each stage of funding to produce a highly defensible valuation.

Importance Of Valuation In Fundraising

In the process of obtaining funds (be it Seed, Series A, or any of the later rounds), the valuation of your startup serves as the most crucial point of reference. This is the expected value of your business before any new funds are added (pre-money valuation), and it determines how much of the business you will give to investors in exchange for their money. Defensible Valuation is the foundation of successful fundraising.

Using standard techniques in corporate finance such as Discounted Cash Flow (DCF), is for the most part infeasible when trying to value early stage startups due to the fact that it tends to lack sufficient historical information such as revenue, reliable record of profits, and a steady growth trend. It is to bridge this common deficiency that we designed the Advanced Startup Valuation Calculator.

About Our Advanced Startup Valuation Calculator

Our Advanced Startup Valuation Calculator is specially tailored to offer essential valuation metrics to the high-growth global startup ecosystem and to market-specific scenarios. It effectively combines two of the most popular and practical valuation methods used by VCs and Angels today:

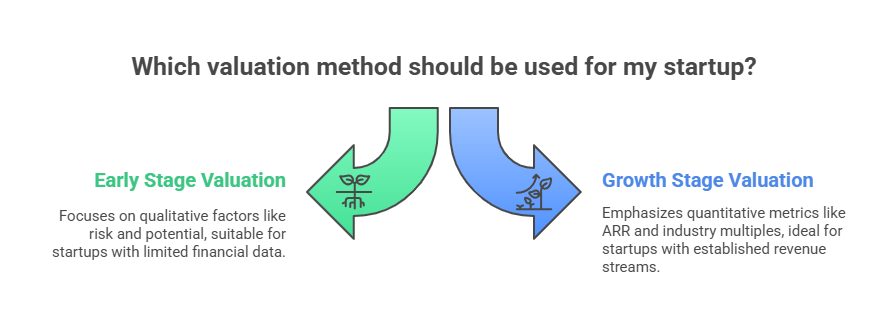

Early/Pre-Revenue Stage (Qualitative): Economic value is measured with the Risk Factor Summation Approach. This method determines the intangible strengths and risks of the business, and is ideally suited for ventures that are pre-product, pre-revenue, or are in the search for their first seed capital.

Growth/Revenue Stage (Quantitative): Economic value is measured by the Revenue Multiples Approach. This method is applicable to the established firms with consistent Monthly Recurring Revenue (MRR) and is community value-based.

Key User Features and Benefits:

| Feature | Benefit |

| Dual Methodology | Automatically switches calculation logic based on your stage, ensuring the result is highly relevant. |

| Dynamic Currency Selector | Instantly view results in INR (₹), USD ($), EUR (€), and other major currencies. |

| Simple Math, Free Mind | Our tool handles the complex calculations, freeing you to concentrate on the crucial aspects of investor negotiation. |

| Negotiation Range | Receive a clear, suggested negotiation bandwidth (±15%) to inform your pitching strategy. |

How Our Startup Valuation Calculator Works

The accuracy of this tool comes from its commitment to applying distinct mathematical and analytical principles appropriate for each startup stage.

1. Early Stage Valuation – The Risk Factor Summation (Qualitative Logic)

This method provides justification for a startup’s worth when tangible revenue metrics are absent. It starts with a base value reflective of the market and adjusts it based on performance against critical qualitative factors.

- Step 1: This is where you start: You input a number (let’s say ₹10000000 for ₹1 Crore or $1 Million) corresponding to the standard seed-stage deal size in your market. This establishes the initial valuation.

- Step 2: Risk Factor Adjustments: You rate your company across three critical areas. Each rating corresponds to a fixed internal monetary adjustment applied to the base value.

| Risk Factor (Focus Area) | Adjustment Value (Example INR Base) | Detailed Rationale |

| A. Management Team Experience | Value ranges from +50,00,000 to -25,00,000 | Highest Weightage: Experienced, committed, and well-rounded teams are the biggest de-risking factor for early-stage investors, receiving the largest positive adjustment. |

| B. Product-Market Fit (PMF) | Value ranges from +50,00,000 to -50,00,000 | High Weightage: Clear proof of PMF (via early traction, waiting lists, or successful pilots) is crucial. Lack of clear direction carries a significant negative adjustment. |

| C. Market Size (TAM/SAM) | Value ranges from +25,00,000 to -25,00,000 | Medium Weightage: A large, easily scalable Total Addressable Market (TAM) is rewarded, while a niche or saturated market limits growth potential and valuation. |

The final qualitative valuation is simply the sum of the Base Value and all selected Risk Factor Adjustments. This creates a transparent and logical narrative for your valuation.

2. Growth Stage Valuation – The Revenue Multiples Method (Quantitative Logic)

This method uses the company’s financial performance and industry context to derive a market-based valuation.

- Step 1: Annual Recurring Revenue (ARR) Calculation: The calculator takes your input Monthly Recurring Revenue (MRR) and annualizes it, establishing the foundational metric.

- Step 2: Applied Multiple Selection: You select your Industry Type (SaaS, FinTech, E-commerce, etc.) which corresponds to a standard peer group valuation multiple (X times ARR).

- Step 3: Growth Rate Weighting: Your Annual Growth Rate (%) input is critically important. High growth rates are mathematically factored in to slightly adjust the base multiple upwards. This ensures that a company growing at 100% is valued higher than one growing at 20%, even if their ARR is currently identical.

- Step 4: Final Valuation Derivation: Valuation = ARR multiplied by (Adjusted Valuation Multiple)

How to Use the Startup Valuation Calculator (Step-by-Step Guide)

Using the Startup Valuation Calculator is designed to be highly intuitive and fast:

- Select Currency: Please select your preferred Currency (USD, INR, EUR, etc.) from the Currency Selector. This selection will be taken into account in every calculation as well as in the results.

- Choose Startup Stage: Choose the radio button for Early/Pre-Revenue (qualitative) or Growth/Revenue (quantitative).

- Input Data:

- For Early Stage: Enter your chosen Base Valuation (Value Only) and make a selection for each of the three mandatory Risk Factors (Team, PMF, Market).

- For Growth Stage: Enter your current MRR (Value Only), your Annual Growth Rate (%), and select the appropriate Industry Type and corresponding Valuation Multiple.

- Analyze the Results: The Final Estimated Pre-Money Valuation will display immediately, providing the exact number, the method-specific metric (Total Adjustments or ARR Multiple), and the critical suggested Negotiation Range (±15%).

Common Startup Valuation Mistakes to Avoid

A valuation number is just the beginning. There are a number of mistakes that founders commonly make with valuation, and business theres a few things that can throw the process off the rails.

Mistake 1: Anchor Bias (Being fixated on one number): Founders typically focus too much on the first valuation they hear (the anchor). Investors will aggressively challenge this. When using U1’s calculator, always utilize the Calculation Range as your actual starting point.

Mistake 2: Ignoring Market Comps: Even if you are doing the Risk Factor method, investors will dissolve your valuation based upon recently funded comparible startups in your region and vertical. Always look up recent sales of the same type (Comps).

Mistake 3: Over-counting Intangibles: Passion and vision are everything, but if they are worth too much on paper, that’s an error. Make sure the good things you are trying to bring to the qualitative phase, come with your numbers (strong PMF score that comes with 0 churn or high referral etc.)

Mistake 4: Not Understanding Revenue Multiples – Applying SaaS Multiple (12x ARR) to a low-margin E-commerce business is a deal killer. You are always going to multiply by the factor that matches your industry and gross margin.

Strategies to Boost Your Valuation

Valuation is fluid, it’s a reflection of how well you can manage the investor’s risk. Apply these tactics prior to starting your fundraising campaign in order to set reasonable precedent:

Lock down Tier-1: Advisors/Investors: Being able to say there are well-known entities on your cap table or advisory board is instantly de-risking, which allows a higher opening valuation.

Illustrate PMF Velocity: Prove you hit product-market fit quicker and cheaper than competition. You can measure this in high NPS and low CAC.

Double down on the QUALITY of revenue: In growth stage, lock in long term contracts (annual versus month to month) and a high gross retention rate. Higher quality of recurring revenue translates to higher multiples.

Protect IP and Technology: Show patents, your own algorithms and data sets which give you a large competitive moat. This warrants positive modifications to the qualitative assessment.

Valuation and the Exit Strategy

Ultimately, an investor’s main goal is not the current valuation, but the Exit Valuation—the price at which your company will eventually be acquired or go public.

The current pre-money valuation must be balanced carefully. If the valuation is too low, you give away too much equity too early (Excessive Dilution). If the valuation is too high, you set a bar that is impossible to meet in the next round (Down Round Risk).

A thoughtfully-selected valuation, like the one you get from this calculator, helps you set a price that’s high enough to save sufficient equity for future fundings and low enough to make the offer of your current investors attractive.

Frequently Asked Questions (FAQs)

What does the “pre-money valuation” mean in Startup Valuation Calculator?

Pre-money valuation is the value of your company before any new external investment is added. It’s the figure used to determine how much equity an investor receives for their cash.

Is this Startup Valuation Calculator free?

Yes, this Startup Valuation Calculator is 100% free to use. You can receive an instant estimate without signing up or commitment.

Which valuation method should I choose?

Choose the Early Stage (Qualitative) if you’re pre-revenue. Opt for the Growth Stage (Quantitative) method if your business produces reliable Monthly Recurring Revenue (MRR).

How does the Startup Valuation Calculator arrive on the Negotiation Range?

The Negotiation Range is an often used industry norm of ±15% based on the estimated final valuation. This gives you a sense of what’s too high and low to talk about with investors.

Why are early stage valuations based on risk, not revenue?

The early-stage startups also do not have any financial histories to make standalone revenue-based methods work. As such, valuation depends on qualitative factors that can be used to analyze the “team’s experience” the “size of the market” and the “product-market fit”. These are root causes of future risk and upside.