Capital budgeting is a must-know skill for anyone studying finance, as it helps businesses decide which big projects—like buying machines or opening new stores—are worth the investment. Understanding capital budgeting, along with cost of capital and ratio analysis, is key to acing exams and shining in internships. This guide breaks down popular capital budgeting techniques (NPV, IRR, Payback Period), explains how to calculate the cost of capital, and shows how ratio analysis supports smart financial decisions. With real-world examples and simple explanations, you’ll be ready to tackle these topics like a pro.

What Is Capital Budgeting?

Capital budgeting is the process businesses use to evaluate and choose long-term investments, like new equipment or expansion plans. It’s about figuring out if a project will make enough money to justify the cost. For students, mastering capital budgeting means nailing numerical questions in exams and analyzing projects in internships.

A 2024 report by Moneycontrol noted that 65% of Indian firms use capital budgeting techniques to plan investments, making this a hot topic in the real world.

Why Capital Budgeting Matters?

Capital budgeting is important because it:

- Guides Big Decisions: Helps pick projects that boost profits.

- Manages Risks: Evaluates if a project is too risky.

- Saves Money: Avoids wasting funds on bad investments.

- Boosts Exam Scores: Often tested with problems on NPV or IRR.

Let’s dive into the three main capital budgeting techniques: NPV, IRR, and Payback Period.

Capital Budgeting Techniques: NPV, IRR, Payback Period

These techniques help businesses decide if a project is worth it. Each has its own way of crunching numbers.

1. Net Present Value (NPV)

What It Is: NPV calculates the value of a project’s future cash flows in today’s money, minus the initial investment. If NPV is positive, the project is good to go.

How to Calculate NPV:

- Estimate yearly cash inflows (money the project will earn).

- Discount them to present value using the cost of capital (more on this later).

- Subtract the initial investment.

- Formula: NPV = Σ (Cash Flow / (1 + Discount Rate)^t) – Initial Investment

Example: A shop invests ₹1,00,000 in a new machine. It expects ₹30,000 yearly cash flow for 5 years. The cost of capital is 10%.

| Year | Cash Flow (₹) | Discount Factor (10%) | Present Value (₹) |

|---|---|---|---|

| 1 | 30,000 | 0.909 | 27,270 |

| 2 | 30,000 | 0.826 | 24,780 |

| 3 | 30,000 | 0.751 | 22,530 |

| 4 | 30,000 | 0.683 | 20,490 |

| 5 | 30,000 | 0.621 | 18,630 |

| Total PV | 1,13,700 | ||

| Less: Initial Investment | 1,00,000 | ||

| NPV | 13,700 |

Verdict: Positive NPV (₹13,700) means the project is profitable.

Real-World Example: In 2024, Reliance Jio used NPV to evaluate its ₹50,000 crore 5G rollout, ensuring future revenues outweighed costs, per Business Standard.

2. Internal Rate of Return (IRR)

What It Is: IRR is the discount rate that makes NPV zero. If IRR is higher than the cost of capital, the project is a winner.

How to Calculate IRR:

- Use trial and error or software (like Excel) to find the rate where NPV = 0.

- Formula: 0 = Σ (Cash Flow / (1 + IRR)^t) – Initial Investment

Example: Using the same shop project (₹1,00,000 investment, ₹30,000 yearly for 5 years), Excel shows IRR ≈ 15%. Since 15% > 10% (cost of capital), the project is good.

Why It’s Useful: IRR helps compare projects. Higher IRR = better project.

3. Payback Period

What It Is: Payback Period tells how long it takes to recover the initial investment from cash flows. Shorter is better.

How to Calculate:

- Add up cash flows until they equal the investment.

- Formula: Payback Period = Years before full recovery + (Remaining amount / Next year’s cash flow)

Example: ₹1,00,000 investment, ₹30,000 yearly cash flow:

- Year 1: ₹30,000 (₹70,000 left)

- Year 2: ₹30,000 (₹40,000 left)

- Year 3: ₹30,000 (₹10,000 left)

- Year 4: ₹10,000 / ₹30,000 = 0.33 years

- Payback Period = 3 + 0.33 = 3.33 years

Verdict: If the shop wants recovery in 3 years, this project is slightly slow.

Exam Tip: Practice NPV and IRR numericals, as they’re common in tests.

Understanding Financial Statements: Final Accounts, Cash Flow vs Fund Flow, and Real Case Studies

Cost of Capital: Meaning, Components & Calculation

The cost of capital is the minimum return a business must earn on its investments to satisfy investors (like shareholders or lenders). It’s used as the discount rate in NPV and to compare with IRR in capital budgeting.

What Is Cost of Capital?

It’s the cost of raising funds, like paying interest on loans or dividends on shares. A 2023 Investopedia article noted that Indian firms average a 10-12% cost of capital, depending on their funding mix.

Components of Cost of Capital

- Cost of Debt: Interest rate on loans (after tax benefits).

- Example: A 10% loan with 30% tax rate = 7% after-tax cost.

- Cost of Equity: Return shareholders expect (e.g., dividends or stock growth).

- Example: Estimated via models like CAPM (Capital Asset Pricing Model).

- Weighted Average Cost of Capital (WACC): Combines debt and equity costs based on their proportion.

- Formula: WACC = (E/V × Cost of Equity) + (D/V × Cost of Debt × (1 – Tax Rate))

- E = Equity, D = Debt, V = E + D

How to Calculate WACC

Example: A business has ₹60,000 equity (12% cost) and ₹40,000 debt (8% cost, 30% tax rate).

- Cost of Debt (after tax) = 8% × (1 – 0.3) = 5.6%

- WACC = (60,000/1,00,000 × 12%) + (40,000/1,00,000 × 5.6%) = 7.2% + 2.24% = 9.44%

Real-World Example: Tata Motors used a 10% WACC in 2024 to evaluate its EV factory investments, ensuring projects beat this hurdle rate, per Economic Times.

Why It Matters: In capital budgeting, cost of capital helps decide if a project’s returns (like IRR) are high enough.

Importance of Ratio Analysis in Financial Decision-Making

Ratio analysis uses financial data to evaluate a business’s performance, guiding decisions in capital budgeting. It’s like a health check-up for finances.

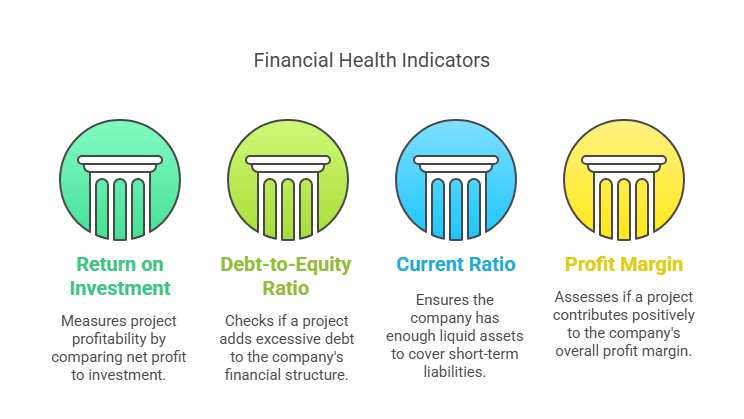

Key Ratios for Capital Budgeting

| Ratio | Formula | Use in Capital Budgeting |

|---|---|---|

| Return on Investment (ROI) | (Net Profit / Investment) × 100 | Measures project profitability. |

| Debt-to-Equity Ratio | Total Debt / Total Equity | Checks if a project adds too much debt. |

| Current Ratio | Current Assets / Current Liabilities | Ensures liquidity for project operations. |

| Profit Margin | (Net Profit / Sales) × 100 | Assesses if a project boosts overall profits. |

Why Ratio Analysis Helps

- Evaluates Projects: ROI shows if a project’s returns justify costs.

- Manages Risk: Debt-to-equity ratio flags if funding is too loan-heavy.

- Supports Decisions: High profit margins from a project signal success.

- Exam Tip: Memorize these ratios for theory and numerical questions.

Real-World Example: In 2023, Asian Paints used ratio analysis to approve a ₹2,000 crore factory expansion. A 15% ROI and low debt-to-equity ratio (0.3) confirmed it was a safe bet, per Forbes India.

Real Case Study: Reliance Jio’s 5G Investment

Let’s see how capital budgeting, cost of capital, and ratio analysis work together with Reliance Jio’s 2024 5G rollout, based on Moneycontrol data.

Background

Jio invested ₹50,000 crore in 5G infrastructure, aiming to lead India’s telecom market.

Analysis

- Capital Budgeting:

- NPV: Jio estimated ₹60,000 crore in cash flows over 10 years, with a 10% cost of capital, yielding a positive NPV.

- IRR: Calculated at 18%, well above the cost of capital.

- Payback Period: 4 years, acceptable for a tech project.

- Cost of Capital:

- Jio’s WACC was ~9%, with 60% equity (12% cost) and 40% debt (6% after-tax cost).

- The 5G project’s 18% IRR beat this benchmark.

- Ratio Analysis:

- ROI: Projected at 20%, showing strong returns.

- Debt-to-Equity: Increased to 0.8 but stayed manageable.

- Current Ratio: 1.5, ensuring liquidity for operations.

Takeaway

Jio’s use of capital budgeting ensured the 5G project was profitable, cost of capital set a clear benchmark, and ratio analysis confirmed financial stability. Students can use this approach in internship projects to analyze company investments.

Tips to Excel in Capital Budgeting

To shine in exams and internships:

- Practice Numericals: Solve NPV, IRR, and WACC problems from past papers.

- Memorize Ratios: Know ROI, debt-to-equity, and their formulas.

- Use Real Examples: Mention firms like Jio in answers for extra marks.

- Check Online Resources: Sites like AccountingCoach have free practice questions.

- Prep for Vivas: Explain why NPV is better than Payback Period.

Conclusion

Capital budgeting, cost of capital, and ratio analysis are powerful tools for making smart financial decisions. By mastering NPV, IRR, and Payback Period, you can evaluate projects like a pro. Understanding the cost of capital helps set benchmarks, while ratio analysis ensures projects boost profits and stability. Real-world examples, like Reliance Jio’s 5G rollout, show how businesses use these tools to grow. Use this guide to ace your exams, impress in internships, and get ready for a finance career.

👨💼 Author: BBAProject Editorial Team

✍️ The BBAProject Editorial Team comprises business graduates and educators dedicated to creating practical, syllabus-based learning resources for BBA students.

⚠️ Please Note: Articles published on BBAProject.in are well-researched and regularly updated. However, students are advised to verify data, statistics, or references before using them for academic submissions.