Picture running a business in which a price increase or an unpaid bill from a client can destroy profit in a day. That’s the role of Financial Risk Management, working like a safety net for businesses not to succumb to financial shocks. In today’s rapidly changing economy, knowing how to address risks such as market changes or cash shortfalls is the secret for anyone wishing to achieve Business Success. Whether you are a student of finance, working on a project at university or entering the professional world, learning how to handle Risk Strategies can make or break a company’s development.

This guide delves into what Financial Risk Management entails, the different types, important strategies, and how they work in practice, complete with clear examples for you to understand the world of finance better.

What is Financial Risk Management and Its Importance

Financial Risk Management is the identification, analysis and management of risks that create financial instability within a business. It’s similar to planning a road trip complete with map and spare tyre so you won’t end up stranded. The risks may be sparked by a shake-up in the marketplace, defaulting debts or production faults, and managing them prevents a business from losing money. In finance and accounting, this subject is a core tested by numerical questions (such as calculation of risk exposure) and theoretical questions (such as classification of risk).

In India’s dynamic economy, Risk Strategies are vital for businesses facing challenges like volatile currency rates or rising costs. For example, a small retail business might lose profits if raw material prices spike unexpectedly. By using Financial Risk Management, businesses can plan ahead, like locking in prices to stabilize costs. This skill is essential for academic projects, internships, and careers in finance, helping you analyze risks and recommend solutions that drive Business Success. Example: A shop owner forecasts a 10% cost increase and uses fixed-price contracts to save ₹30,000 annually.

Types of Financial Risks in Business

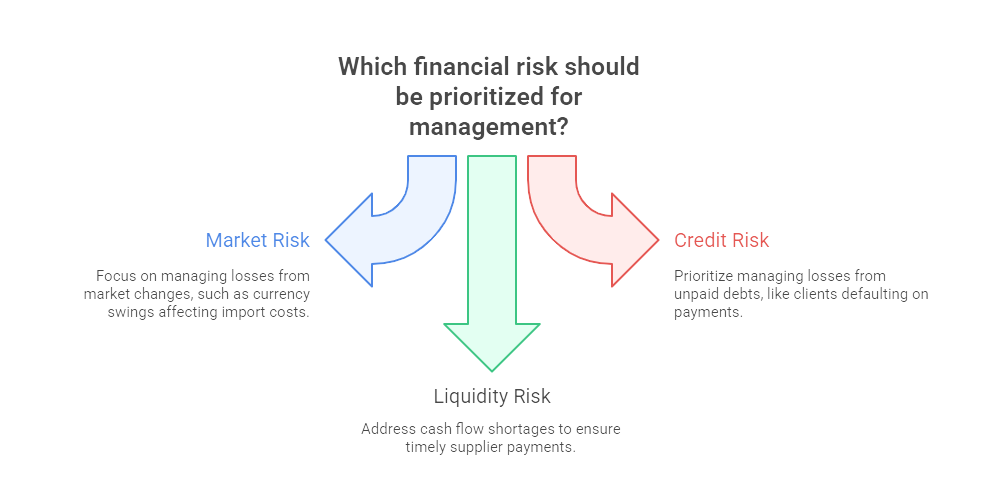

Comprehension of the financial risk types underpins the formulation of the best Risk Strategies. The following are the principal ones:

- Market Risk arises from fluctuating market forces, such as rates of interest or currency rates. For example, an import company may incur losses in case the rupee falls in value relative to the dollar.

- Credit Risk arises from the failure of customers or borrowers to settle payments, for example a shopkeeper facing unpaid cheques from clients.

- Liquidity Risk arises where a business does not have cash for meeting expenses, for example a shop which cannot settle payments for supplies for slow sales.

- Operational Risk arises from internal matters such as system breaks or fraud affecting profit. Example: A business incurs a loss of ₹40,000 owing to a wrong account entry (operation risk), eating into its budget.

Each risk entails distinct Risk Strategies for mitigating impact and this knowledge is therefore essential for finance projects and careers. Example: An export company is subject to market risk due to currency changes and this affects profit margins by 5%.

Key Strategies to Manage Financial Risks

Efficient Financial Risk Management employs smart Risk Strategies for business safeguarding. The following strategies are the best ones:

- Diversification helps reduce market risk by spreading investments across different products or markets. A store can sell clothes and electronics in order to avoid losses in the event one line of business does not work.

- Hedging uses financial tools, like futures contracts, to lock in prices and avoid price movements. A business can hedge in order to lock in raw material prices and make savings during price upswings.

- Credit Control helps reduce credit risk by checking the creditworthiness of customers while providing credit. Example: A store implements credit checks and reduces default by 12%.

- Liquidity Management offers cash availability through budgeting and buffers, like keeping ₹1,00,000 as a buffer in case of emergencies.

Numerical Example: A business hedges by locking in a ₹100/unit price for supplies, saving ₹25,000 when prices rise to ₹125/unit.

Check Out – Mastering Capital Budgeting: NPV, IRR, Payback Period with Cost of Capital and Ratio Analysis

Applying Risk Management in Academic Projects and Professional Settings

Financial Risk Management is a real-world skill for work and academics projects. In a finance project, you may assume a hypothetical business like a retail outlet facing price fluctuation (market risk). Suggest hedging in a bid to stabilize costs and credit controls in a situation of unpaid bills. Example: A project advises diversification by adding new product lines and reducing risk exposure by 10%. In real-world work experience, such as during an internship, you might analyze a startup’s cash flow so it can afford costs by utilizing liquidity management.

Numerical Example: An internship assessment shows a business generates a profit of 60,000 INR by hedging a 15% price increase, substantiating the effectiveness of the strategy.

Also check – Budgeting and Forecasting and Break-Even Analysis: Planning for Profitability and Success

Overcoming Challenges in Financial Risk Management

Financial Risk Management application is not a cakewalk. Sophisticated terms like hedging confuse students. Lessen confusion by learning through real-life examples, like how a business safeguards supply rates in order not to incur losses. Example: A store limits material price at a price increase of ₹20,000. Lack of sufficient data for projects is also a difficulty; you might not possess market trends. Reliance on hypothetical cases or secondary resources like government reports. Misinterpretation of risks like mistaking operational risk for market risk is prevalent. Lessen confusion by reading the definition—market risk is from the outside and operational is from the inside.

Numerical Example: A project incorrectly puts a loss of ₹25,000 owing to system failure under the head of market risk; correcting it as operational risk adds accuracy.

Table: Financial Risk Types and Mitigation

| Risk Type | Impact | Mitigation Strategy |

|---|---|---|

| Market Risk | Losses from price changes | Hedging, diversification |

| Credit Risk | Unpaid debts | Credit checks, policies |

| Liquidity Risk | Cash flow shortages | Budgeting, reserve funds |

Conclusion

Financial Risk Management is a necessary ability for Business Success Achievement, which allows you to handle financial risk in a clever manner by utilizing Risk Strategies. Understanding risk types, making use of hedging and diversification strategies, and utilizing challenges can assist you in constructing effective projects and excelling in work careers. Learn this manual and attain Financial Risk Management skills and create opportunities for a successful finance profession.

👨💼 Author: BBAProject Editorial Team

✍️ The BBAProject Editorial Team comprises business graduates and educators dedicated to creating practical, syllabus-based learning resources for BBA students.

⚠️ Please Note: Articles published on BBAProject.in are well-researched and regularly updated. However, students are advised to verify data, statistics, or references before using them for academic submissions.